AI Market Update - March 2025

At our annual meeting in March 2025, we shared an update on how the AI platform shift is starting to play out. Here are 9 graphs that tell the story.

To start, it’s clear that leaders across our industry believe AI is the next major wave of tech innovation. Here are just a few quotes from early leaders of the Internet, SaaS, and Cloud eras who have stated definitively how great they think the potential is for AI to transform our day to day lives.

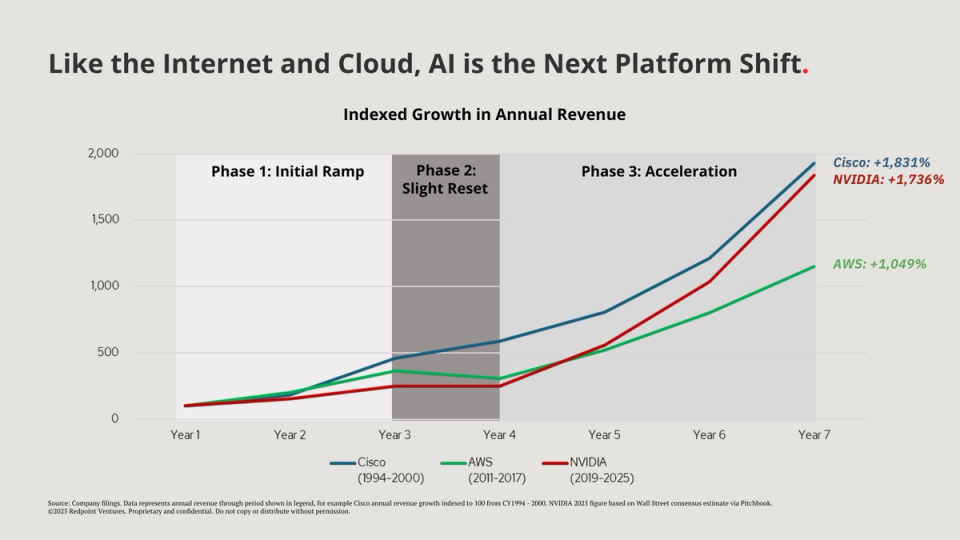

We agree with these tech luminaries and firmly believe AI is the next platform shift, and it presents the next wave of exciting startup opportunities for us to invest in. The growth we’ve seen in NVIDIA over the last 5-6 years mirrors what we saw in the 90s with Cisco and the 2010s with AWS (which predated the Internet and Cloud waves, respectively).

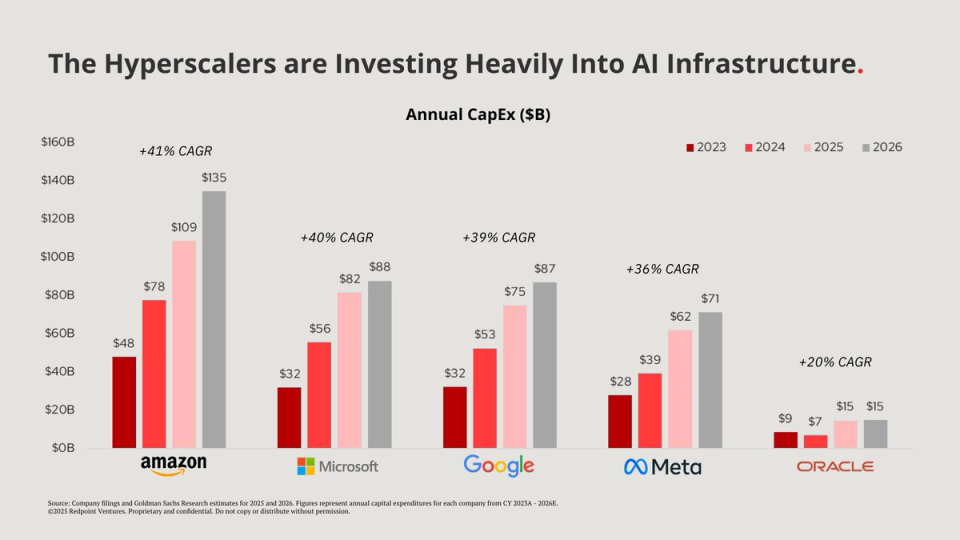

We’ve also seen the hyperscalers investing heavily into this opportunity. Capex for each of them has grown tremendously over the last few years. These companies are excited about the potential of AI and the corresponding demand, so they are investing significantly to capture future revenue opportunities.

What’s exciting: this opportunity is just beginning. In a Goldman CIO survey from last summer, CIOs indicated that while AI is still a small portion of IT budgets today, they expect it to triple in the next few years.

The data below is based on a recent Morgan Stanley research report that developed a bottoms-up view on the opportunity for Enterprise AI.

They forecast over $400B of GenAI Enterprise software spend by 2028, which would be about 5 years post-ChatGPT. The growth they expect in AI spend is staggering - they’re projecting 124% annual growth over the next 4 years relative to the rest of Enterprise Software at a 7% CAGR. By 2028, they expect spend on AI to contribute 22% of Global Software spend. We feel that the opportunity here is massive, and it’s going to come quickly.

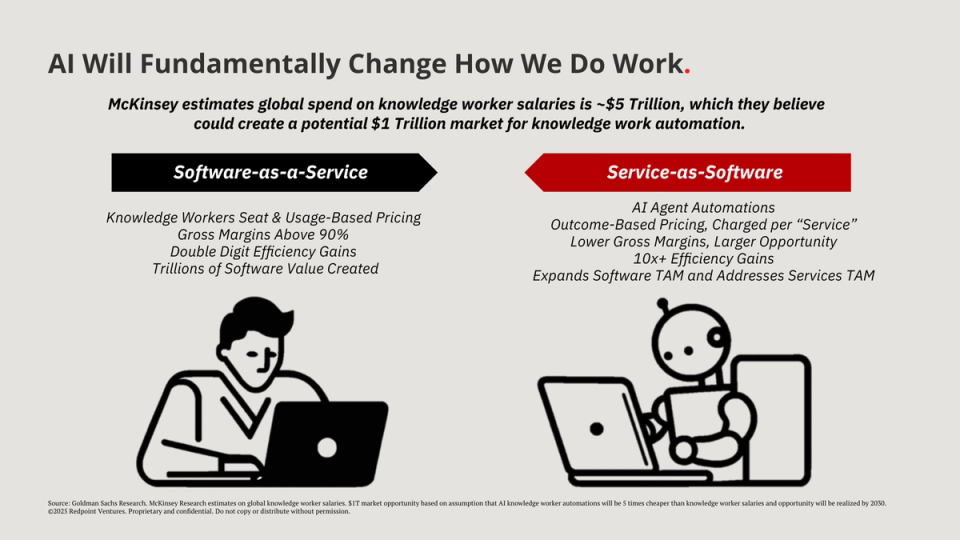

Part of the reason why AI applications are growing so fast is because enterprises recognize this technology is going to fundamentally change how we do work.

The shift from Software-as-a-service to Service-as-software has been discussed a lot, but as AI has gotten more effective and reliable, the upcoming transformation has become somewhat clearer.

We are going to see shifts in:

1. The way we work: shifting from solo knowledge workers to AI agent automations of various low-level tasks

2. Pricing models, the possible margins, and the potential efficiency.

We feel all of this should help unlock the huge market opportunity seen on the prior chart.

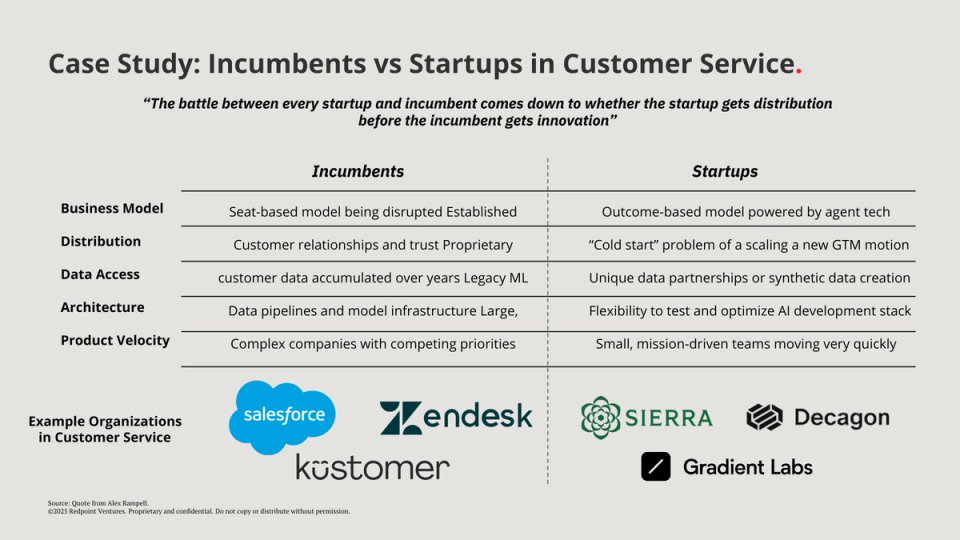

Some of the factors listed below are typical characteristics of the incumbent vs. startup battle - such as distribution (where startups have to play catch up) and product velocity (where startups often have a distinct advantage).

What’s most interesting about the dynamic between AI startups and incumbents is data access and architecture. Incumbents have built systems of record where they already hold valuable enterprise data that could power new AI products.

AI startups need to be more creative about getting access to that sort of data, but they don’t suffer from the same legacy data pipelines or ML infrastructure that incumbents have. Given how much AI infrastructure is changing, startups could benefit from being able to iterate faster on their AI stack and ultimately deliver better AI products at scale.

This is definitely a trend we’ll be watching actively to see if incumbents can deliver enough value with their data advantage before startups have a chance to catch up.

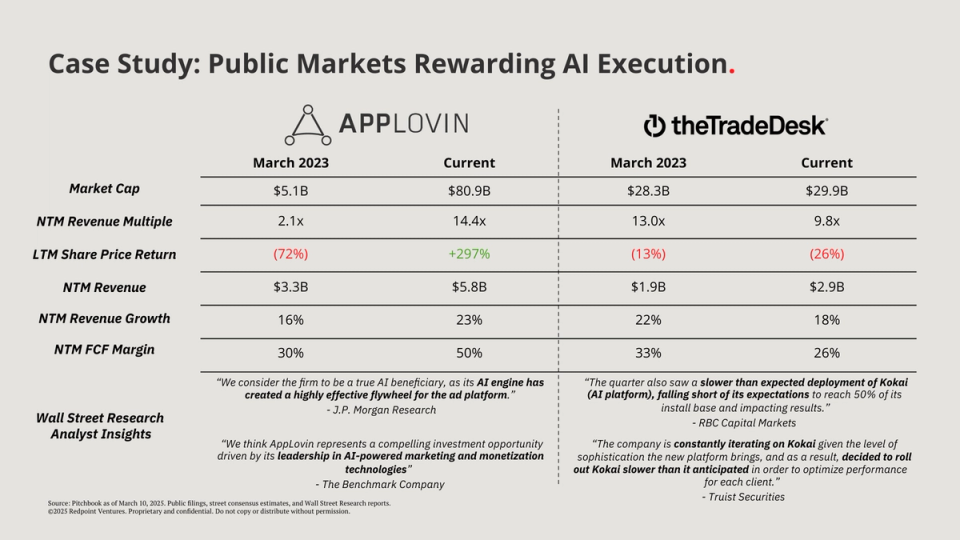

There are a handful of businesses that have capitalized on the AI opportunity with true numbers to show for it, and in looking at the advertising SaaS space, we can see two very different stories.

For example, AppLovin has executed on their AI story very well, enhancing their marketing and monetization technologies with AI to deliver higher performance for their customers and greater profits to their bottom line. Most notably, their growth rate actually accelerated by 7% while their FCF margins grew by 20%, which has allowed their market cap to grow by over $75B+.

TTD, on the other hand, recently highlighted that the transition to their new AI platform has been slower than expected.

While there are similar AI tailwinds behind both these businesses, the differences in execution have caused a major divergence in stock performance over the last year.

While we’re confident that AI represents the next major platform shift, it’s worth acknowledging that this opportunity may resemble the internet era more than the cloud computing wave.

In the internet platform transition, we saw companies like Cisco aggressively build to where they thought the market was heading, only to hit an air pocket of demand when “eyeballs” did not translate to revenue as immediately as people hoped. It’s totally possible that this shift looks more like that than it does the cloud computing market.

Regardless, this will transform the nature of technology and deliver generational companies, but it might take some time to get there.

And it’s important to keep in mind that the major companies weren’t started immediately after the initial moment when everyone realized a platform shift was coming. Google was founded 5 years after Mosaic, while Facebook was 11 years later. It wasn’t until 6 years after AWS launched that Snowflake was started.

Overall, we’re quite excited about the potential opportunities that AI presents. The AI opportunity is still in its early innings, and leading companies are investing quickly. Opportunity is potentially trillions in equity value.

If you're interested in more, check out our other market updates: