Private Markets Update - March 2025

At our annual meeting in March 2025, we shared a deep dive on the current state of the private markets—highlighting key trends across the venture landscape.

AI continues to dominate the early-stage pipeline, driving faster growth, larger rounds, and higher valuations than non-AI companies. At the same time, we’re seeing capital increasingly concentrated in a few private market leaders.

Below is a recap of the presentation, including the key charts and insights across deal volume, AI valuations, and the distribution of venture dollars.

Deal Volume

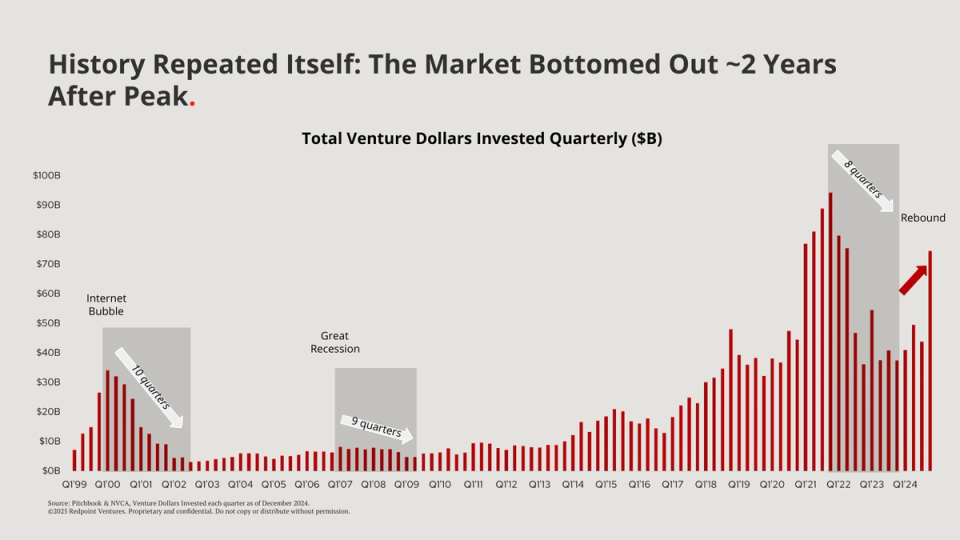

Over the last few years, we saw the peak to trough in a venture correction typically takes 2 to 2.5 years.

This played out with this cycle with the market rebounding after 8 quarters, as it rebounded significantly at the end of Q4 of 2024.

The good news: it’s not just venture investing recovering. Software selling is also improving too.

The following graphs show the rep attainment by quarter for software businesses provided by our portfolio company Bravado. As you can see, there’s been a marked improvement in 2024.

In Q4 2024, 57% of reps hit their quota, which is almost double the percentage we saw in Q4 of 2023.

In the past couple of years, we also saw a reset in venture deal activity. In 2024, Series A activity stabilized. It's still below pre-COVID levels, but it appears we are past the bottom.

At Series B and C, we have started to see a rebound from the absolute lows.

Anecdotally, our team has seen these trends continue so far in 2025 as our deal activity remains strong.

Valuations

From a valuation perspective, it does feel like we’re settling into a new normal in the private markets. Private multiples at Series B and C have come down meaningfully from 2021 levels, but they remain significantly above pre-COVID levels.

The spread between public and private also remains elevated, but it has shrunk over the last year.

It’s important to tie this data with the lack of growth in the public markets. Private companies at Series B and Series C levels are still growing at very healthy levels, whereas there is very little growth in the public markets. So on a growth-adjusted basis, we feel that this environment is far more “reasonable” than what we saw in 2021 and 2022.

The Dominance of AI Startups

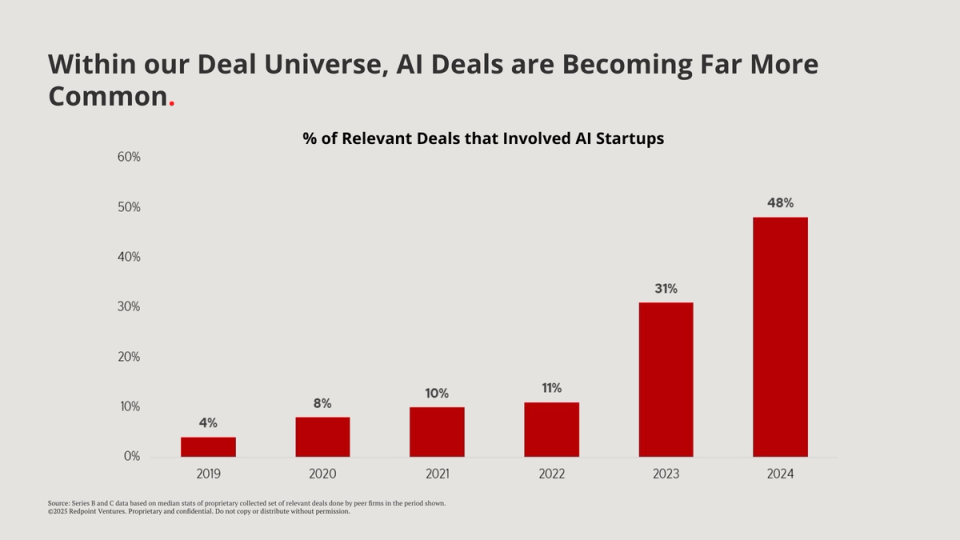

As you'd expect within our core deal universe, AI has become extremely prevalent with it comprising roughly 50% of the opportunities that we’re looking at, which is up from 31% in 2023.

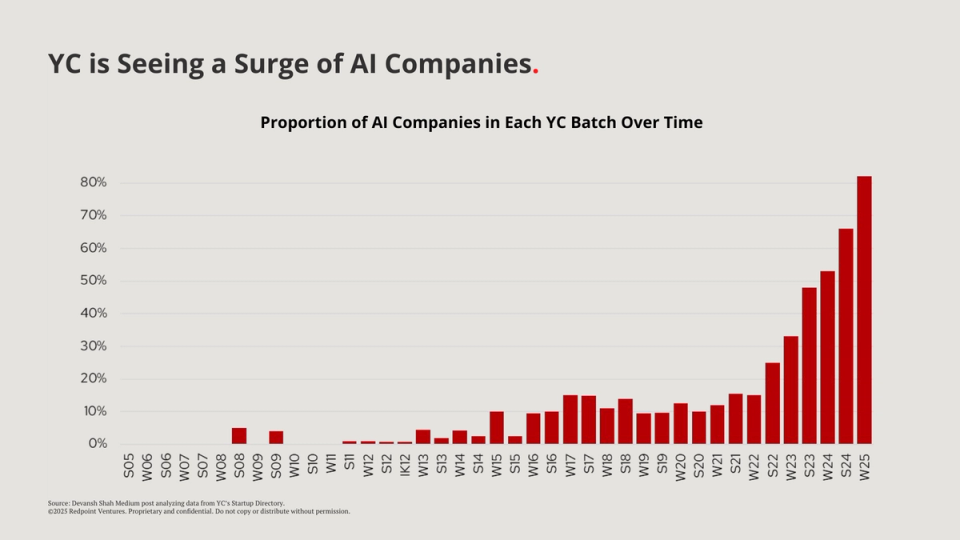

We expect the above trend to continue. The data shown focuses on the stage of market we focus on, but this trend is obviously true at other stages as well. In fact, upfunnel, 82% of companies in the most recent YC batch were AI companies.

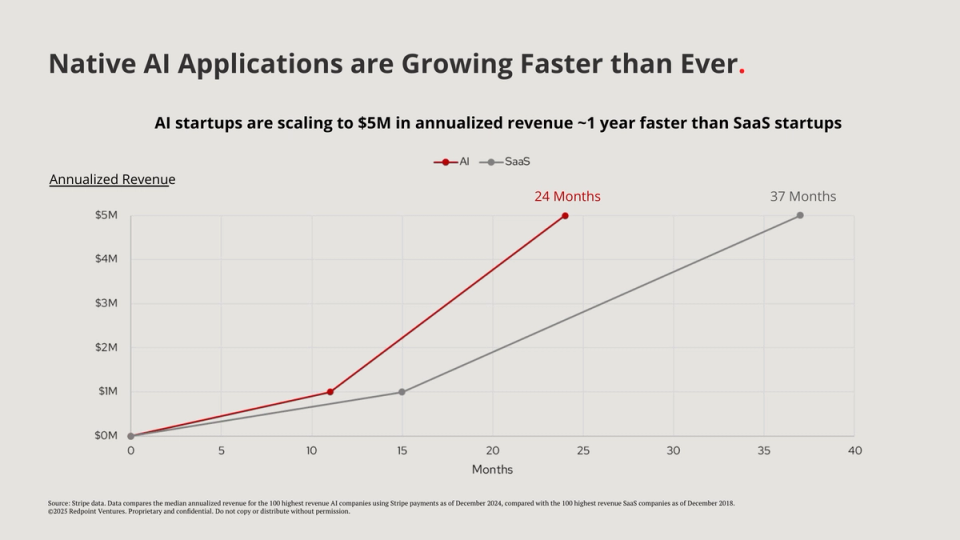

These AI businesses are growing far faster than other companies.

Here's some data from Stripe comparing the highest revenue AI companies that use Stripe with the equivalent high growth SaaS companies from a prior generation.

Top AI companies are reaching $5M in annualized revenue 13 months earlier than the prior SaaS cohort.

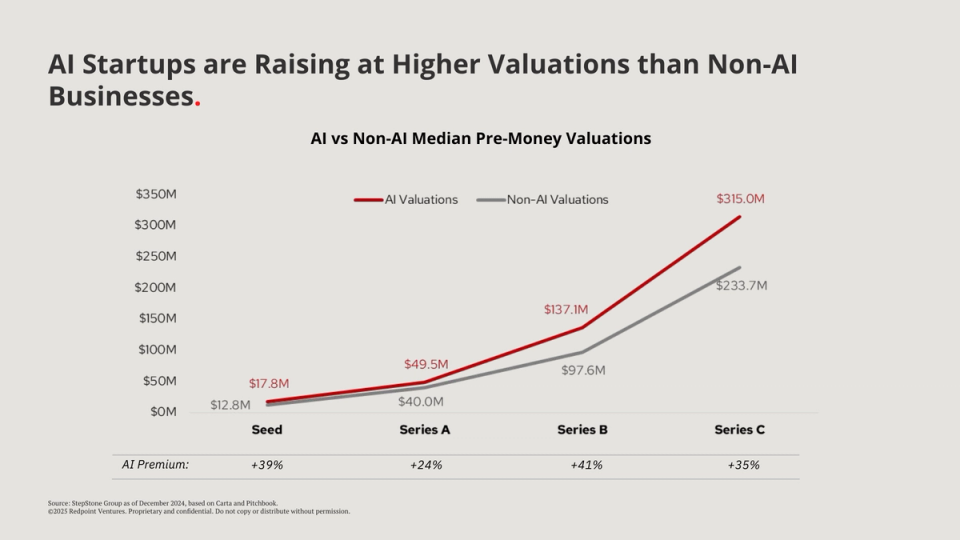

Perhaps unsurprisingly, due to the growth rates and potential opportunity, we’re seeing AI companies raising at higher valuations. The following data from Carta shows seed through Series C valuations, where you’ll see a premium of anywhere from 24% to 40%. However, we actually think that this is quite understated.

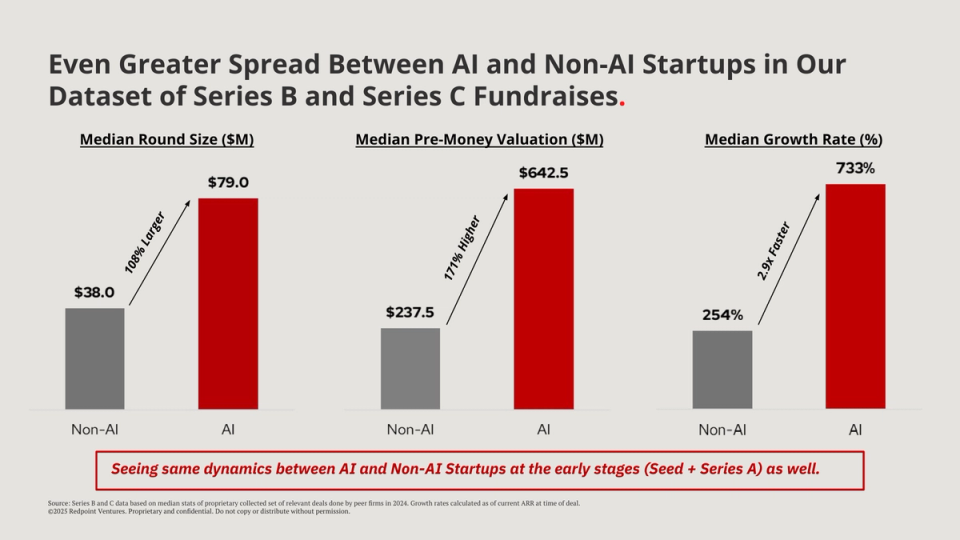

Within our core deal universe of the top 10% of deals, that trend is even more pronounced. AI companies are consistently raising larger rounds, at higher valuations.

Most importantly, they’re also growing meaningfully faster than non-AI businesses and far faster than the data that Stripe showed.

Access to Capital

One other notable trend in the private markets: startups simply have access to more capital than ever before. The next chart shows some of the largest fundraises over the last year.

The access to capital is allowing companies to delay going public and fund significant secondary purchases or capital for compute that simply would not have been possible in the past.

More on this in the liquidity section below.

With some of these massive fundraises, we’re also seeing significant concentration of venture capital into a select few private tech leaders.

The trend has accelerated meaningfully in the last couple of years, with 31% of total venture capital being invested into 20 companies in 2024.

For more information on the state of the market, check out our deep dives into public markets, the exit landscape, and the AI platform shift.