Public Markets Update - March 2025

At our annual meeting in March 2025, we dove into the dynamics shaping today’s public market landscape—from election-year volatility and the performance of the Magnificent 7, to slower revenue growth across public tech companies and the widening gap between top software companies and the rest of the pack.

In the following 14 charts, we break down:

1. How recent market pullbacks are different from past election cycles

2. How growth and profitability are showing up in today’s public tech companies

3. What’s driving the concentration of value creation in a few standout names

4. And how companies are reaching $50B+ valuations faster than ever before

Macroeconomic Trends

First, macroeconomic concerns are growing, largely driven by uncertainty around tariff decisions—and, to a lesser extent, spending cuts related to DOGE.

A number of notable macro investors and economists have come out as bearish in the last few weeks, and this is changing by the day.

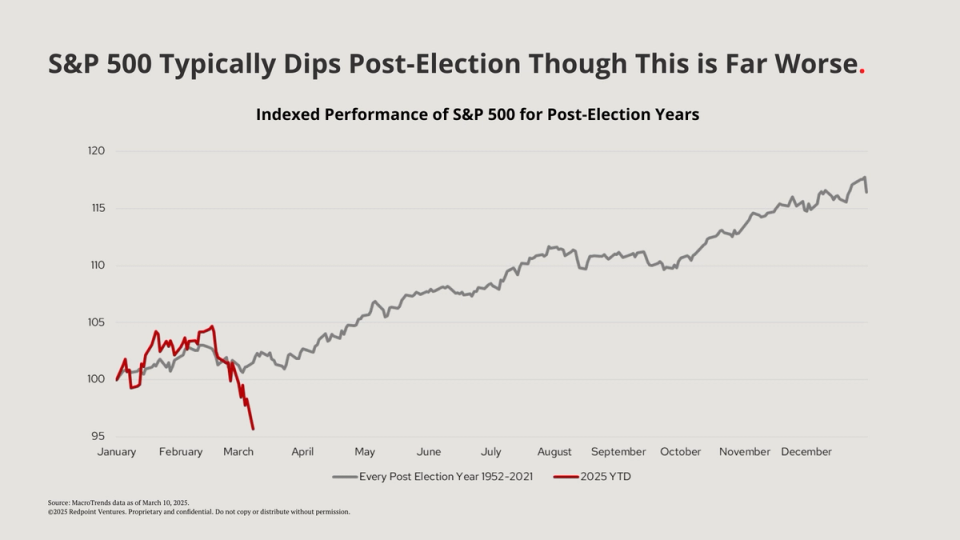

This uncertainty has led to a major market pullback. While we usually see a dip in S&P 500 performance following an election, this year has been more extreme than historical trends.

We’re also seeing far more negative sentiment from CEOs. In just January, Stanley Druckenmiller said that this was the most “pro-business administration in our lifetime,” and now we have a real lack of confidence from CEOs about the next 12 months.

It’s important to note that this still is a relative blip. Despite the recent volatility, the NASDAQ is still near its all-time highs. The NASDAQ is only back down to a level of where we were in September of this past year, and we’re still up 7% over the last 12 months.

Consistent with the last couple of years, the run-up hasn’t been evenly distributed. The Magnificent 7 has driven the lion’s share of the growth in the S&P 500 the last few years and currently represents about a third of the total market cap in the S&P.

While the Mag7 is up quite a bit in the last 5 years, it’s been hit disproportionately hard since the Inauguration, down 16% since January 20th.

When looking at the composition of public tech companies, one fairly recent phenomenon is that there aren’t a lot of true growth opportunities in the public markets. The median growth rate for public tech companies today is only 10%, and only 9% of companies are expected to grow over 20% in the next few years.

There are a few factors at play:

- The global economy is a bit more muted.

- The businesses that are currently public are more mature, as there haven’t been many IPOs of late. The ones that have gone public of late are far larger than in the past.

- The trade-off between growth and profitability

Growth & Profitability

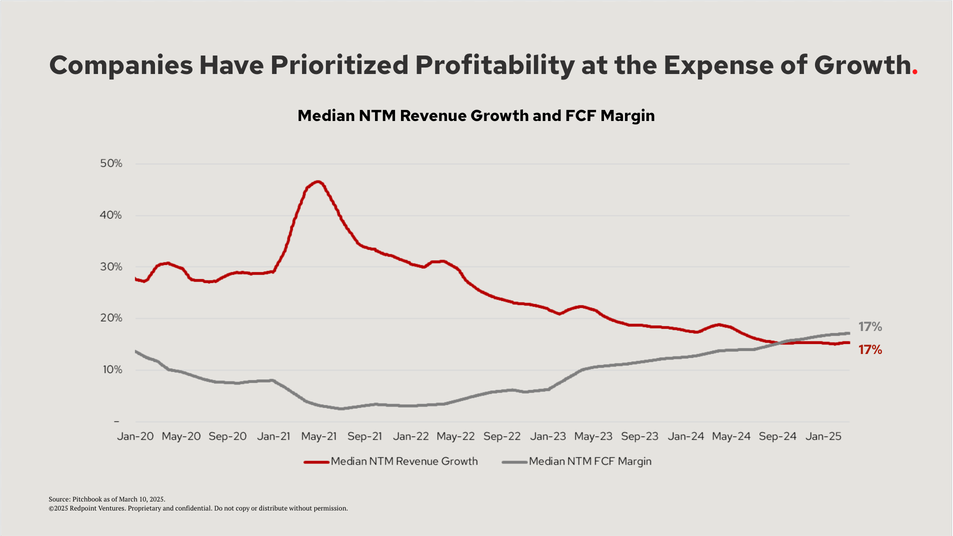

In the public markets, we’ve continued to see companies prioritize FCF at the expense of growth, which has included layoffs or hiring freezes. This has led to more muted growth, and the public market has responded accordingly.

We’ve also seen a lot more predictability in the public markets than in recent years. More companies are hitting their numbers now than at any point since 2021. This is likely a mix of a better buying environment, as well as a reset of expectations.

The Haves & Have Nots

There is also a real stratification between the top software companies and the rest of the pack.

The following chart shows the top 10 software names versus the rest of the pack, and the spread between these names is large even despite the recent sell-off.

The market remains broken into a world of the “haves and have-nots”

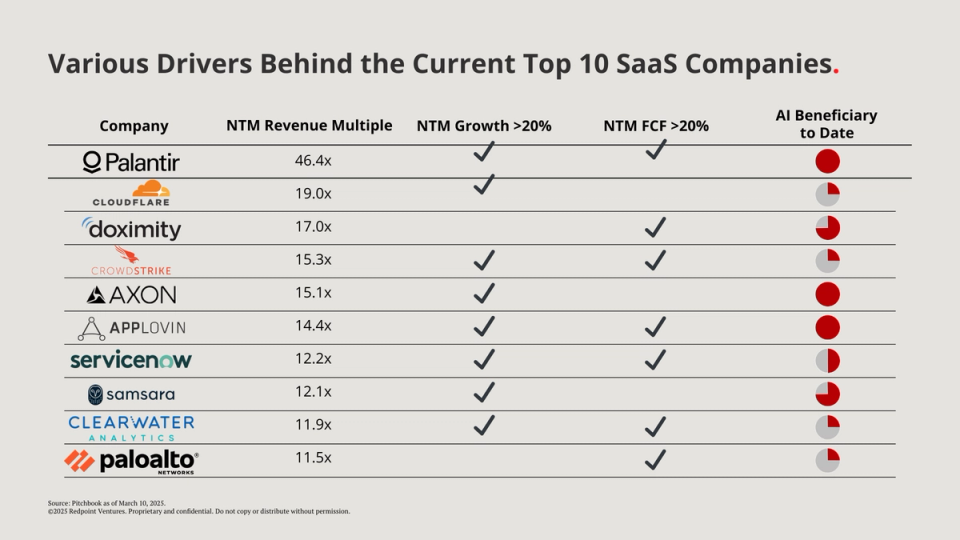

If you unpack the characteristics of these top 10 SaaS companies, you'll see two interesting things.

First, these businesses are growing significantly faster with far better FCF margins than the rest of the market.

Second, these businesses are simply far bigger than the top 10 companies that you’ve seen in the past. The size of these businesses is almost 10x larger than the remaining SaaS universe, which is the biggest spread we’ve seen in recent years.

Within the top 10 SaaS companies, value creation has largely been driven by a combination of strong growth and strong FCF margins. 8 of the 10 public names here have growth rates above 20%, and 7 have FCF above 20%.

In addition, one of the biggest value drivers for a handful of these companies has also been their ability to execute on the AI opportunity in a short time horizon.

Unsurprisingly, the main themes tech companies are focused on include AI, the macro environment, and operational efficiency, and these themes dominated discussion at the recent Morgan Stanley TMT conference.

This further highlights the key areas of emphasis and value drivers that are top of mind for tech companies right now.

Getting to Scale

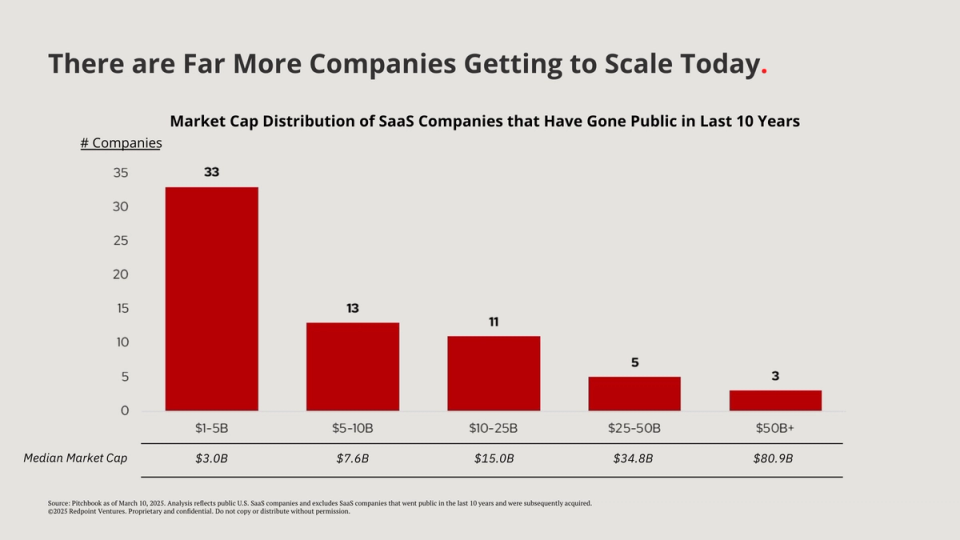

Across the board, public market outcomes are simply far larger than they have been in the past.

The following graph shows SaaS companies that have gone public in the last 10 years. About half of these businesses are worth over $5B, and over 10% are worth over $25B.

For investors, there are a number of opportunities to hit base case return in the $1-10B range, but there are also some massive companies that can drive very outsized returns. More names will hopefully join the list soon.

There aren't just more companies that are worth over $25B or $50B, these companies are reaching a valuation of $50B far faster than ever before.

The following chart shows different B2B technology companies currently worth over $50B and how long it took them to reach that level.

You’ll notice the cohort of businesses founded pre-2000s took a median of 26 years to get a $50B valuation. The companies that were founded in the 2000s took 16 years on average, and more recently, the 2010s cohort has taken only 10 years to get to a $50B valuation.

All in all, public markets continue to push higher with a handful of companies separating themselves from the pack. See all 14 slides below, and check out our deep dive into private markets here.