Redpoint’s AI Investors Break Down What Separates Enduring AI Companies from the Hype

The following transcript is from an AI Panel at Redpoint’s annual meeting with investors in March of 2025. Redpoint partners Scott Raney, Alex Bard, Patrick Chase and Jacob Effron shared thoughts on some of the most topical questions in AI today, where value will accrue, which industries are best positioned for defensibility at the application layer, and more. The full video conversation is available at youtube.com/@RedpointAI.

Scott: As a reminder, the AI panel here today, we want to talk a little bit about how we're approaching investing in the AI landscape today. In order to do this, I wanted Pat and Jacob to join. Pat and Jacob are Cofounders and co hosts of our AI podcast called Unsupervised Learning. It's done incredibly well. And they've been real thought leaders within the firm on AI. And I also wanted to have Alex join us.

Scott: Yeah. Um, as I mentioned earlier too, we really do want this to be interactive.

Scott: So I'm sure a lot of you have questions about. What investing in the AI world today actually means and how we're navigating this. So please jump in along the way. First thing we're going to do is we're going to start with, we've got a few slides here to kind of help put some, some of the numbers in perspective.

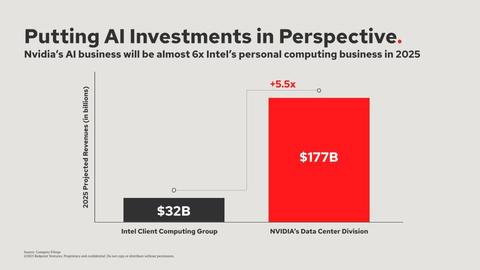

Scott: A couple of things here. If you look at this chart here,

$32B, that's the revenue that the Intel Client Computing Group will generate this year. Those are the CPUs that power the personal computers, represents about 70 percent market share of the personal computing landscape.

Scott: That's 32 billion projected for this year. The NVIDIA data center division, which generates the GPUs that are powering AI training and inference, is projected to be 177 billion. Five and a half times the size of the personal computing market, which is mind blowing.

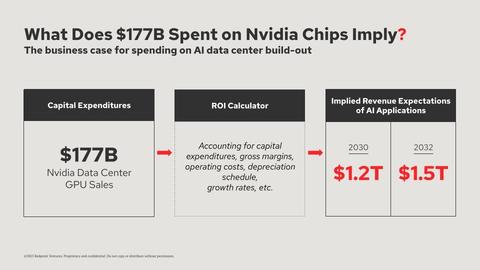

What we wanna do is understand what does that 177 billion in CapEx on Nvidia chips mean If you want to generate a reasonable ROI associated with that, you factor in the costs of the other capital expenditures required to build a data center, AI data center, the gross margins, the operating costs, depreciation schedule, growth rates.

Scott: You pick a reasonable ROI that implies that the people that are spending that money have to be anticipating revenues of about 1.2 trillion by 2030 and 1.5 trillion by 2032. And this jibes with some numbers that we've seen from some top down analysis. So that's 1.5 trillion dollars of revenue generated in the AI landscape by 2032.

Scott: That 1.5 trillion is a market that's going to be built over about 10 years. That compares to the world enterprise software market, the market that's generated trillions of dollars of market cap and market value that's been built over 50 years, which is about 1.1 trillion. So it's staggering what we're talking about here.

Scott: I guess the first question for you all is, do we buy this? I mean, is this the ultimate bubble? Do we think this is, this is achievable? Do we think that these are reasonable numbers? Or do we think that the folks that are making these CapEx expenditures are just way out over their skeeps? Alex, you want to start us off.

Alex: Well, for everybody in this room, I hope that that number is understated. Actually, no, look, during Logan's presentation, I think you saw four of some of the smartest technology leaders in the world with quotes on their excitement for AI, whether it's Benioff who said it's the biggest technological breakthrough he's seen in his entire lifetime, and obviously he's lived through a lot, or Gates, or Bezos, or Eric Schmidt, so, I think, one, that signals an incredible excitement and exuberance for what AI can bring, and as we move up the ladder of, of AI capability, with every new rung, more incredible opportunity, I think, is unlocked. So, first of all, I think that these companies have to make this investment, whether or not it leads to the ROI or not, whether it actually pencils out, because it's a strategic imperative. You cannot be left behind not making this investment. And so one, I think it's a strategic imperative, regardless of the ultimate.

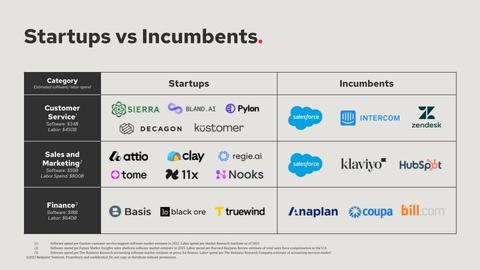

Alex: Secondly, the other slide that Logan presented, which I think is spot on, you talk about software as a service, which created a lot of the value we see here. Now it's moving to services software, which is AI is actually not making a human incrementally more efficient. It's actually doing the job of a human.

Alex: And if you look at traditional software to labor budgets, labor budgets are an order of magnitude, in many cases, more larger than software budgets have been historically. If you just think about, like, just take customer service, where we're seeing a lot of momentum and AI. The customer service software market is roughly 35 billion.

Alex: The human cost of that is 450 billion. Right? There's kind of order of magnitude greater. And so if AI can start to do some of that work, you can imagine, kind of significantly larger budgets being unlocked in support of that. And then the third thing that I sort of mentioned that I think underwrites to this being realistic or potential, let's say, is that there are a lot of markets that historically have been under penetrated by software, because the market was either too small for the seat based kind of traditional model, or because the users in that market aren't sophisticated to be able to use that software, and we're seeing AI coming into those markets and expanding the size of those markets and going into new markets.

Alex: So, you know, Who knows? Nobody has a crystal ball, but it seems not unreasonable.

Scott: You know, I guess for us, from our standpoint, we're not the ones spending 177 billion on So if it's a fraction of this number we're going to be just fine and our companies are going to have an opportunity to create a lot of value.

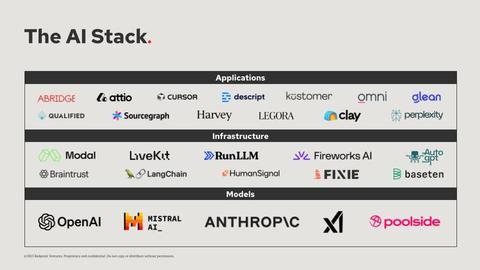

Scott: This is the simple model of thinking about the way to view the AI landscape.

And it starts at the model layer. The models are kind of the brains that the LLMs and other models that power the applications that will deliver AI capabilities. There's the infrastructure layer, which are kind of the picks and shovels that, that bridge the gap between the models and the application vendors.

Scott: It's what the developers are going to use to build AI applications. And then finally, at the application tier we have these companies, both horizontal and vertical SaaS solutions that are building unique capabilities that have a chance to kind of replace some services with software. Let's start with the model layer.

Scott: Jacob, walk me through your thinking on model layer. What are some of the recent developments that are underway here that we think are particularly interesting?

Jacob: Yeah I think it's becoming increasingly clear that the value of these model companies are the products that you can build on top of them.

Jacob: And so if you think of OpenAI and ChatGPT, which I'm sure you've all used but they've recently shipped products like Deep Research, talked about Enterprise AI Agents, and I think what building a cutting edge foundation model allows you to do is you're really one of the three, four companies that can actually build these products because they require the state of the art model, and if you have a model that is 10 IQ points higher than, the best of open source, you really do have the opportunity to build a really unique set of products. Now obviously the cost to get in the state of the art LLM game is so prohibitively expensive at this point that we don't look at a ton of net new LLM companies, but I do think there's adjacent model categories, that are different than LLMs and require different data.

Jacob: That are really interesting for us, robotics is one of those areas, where we invested in Physical Intelligence, and that's because there's a whole different set of data that's required to get models to be able to take action in the real world. Another category that comes to mind is biology, material sciences, I think those are gonna be really interesting areas for us over the next few years.

Scott: Great. What about DeepSeek? You know, there's a lot of news, Pat, about DeepSeek, and what are the implications for investing in the model layer, but also, you know, for those of us who are trying to build solutions on top of these models?

Pat: Yeah, totally. I think the DeepSeek announcement was fascinating, right? And obviously sent a ripple through the market, I think the, the two takeaways for me were one, models are getting cheaper. And so this is great for application companies that are building on top of them as those costs continue to drop, they're dropping about 10x a year for inference and 10x a year for training as well.

Pat: That will mean better margin structures for all the applications that are building on top of them. The second is I think it showed to the model companies that scale is not an enduring moat. So just because you have the biggest GPU cluster doesn't mean you're necessarily gonna have the best model or no one's gonna have a model that's as good as yours.

Pat: So I think they're gonna look to build their moats in one of two ways. Either through distribution, like OpenAI moving up the stack, and they're launching a bunch of kind of apps and agentic stuff recently. Or through specialization. Kind of Jacob was just talking about the robotics examples.

Pat: So I think they're going to kind of go in those two directions. But yeah, models are commoditizing.

Scott: Yeah, I mean it's one of the things we saw across our portfolio. Within weeks of DeepSeek's release a significant number of our portfolio Anthropic to DeepSeek and they were seeing . Cost reductions of about 80 to 90 percent and what and what was needed to power the inference on the models, which is pretty extraordinary.

Pat: And the switching costs are really low, right? Like if you, if a new model comes out, you can plug that in. If similar performance, there's it's not really like the cloud where you have to move a bunch of code over. You can just redirect.

Scott: So like these model companies, it's interesting because they're definite, like appears various entry associated with the dollars that are being invested in building something like what Anthropic builds.

Scott: But on the other hand there's very low switching costs, like we saw with the, within our portfolio company. They were able to move off of Anthropic onto DeepSeek within days. Alright, let's talk about the infrastructure layer. Redpoint has historically done a lot of investing here at this infrastructure layer.

Scott: In the cloud wave, you had the, the AWS is a world that we're building the, the compute and storage, networking infrastructure as a service that companies are able to build. And then there's a whole set of tooling that was built on top of that, that was required to really take full advantage of that and to secure the applications store data, databases, all that stuff.

Scott: So I think when the AI wave started, we were like, hey, infrastructure is going to be an incredible opportunity for us. We're going to really lean in here. But it really hasn't played out that way for us. It's actually been an area that's been pretty slow. We do have some great examples of companies in Modal, but we haven't done that much investing here.

Scott: Why is that the case?

Jacob: Yeah, I mean, it's obviously where we initially thought to look. I think it's been slow for two reasons. The first is the model layer is just changing so fast that the patterns that builders are using changes at that speed too. So every three months it feels like there's a new model, a new way of doing things. And then the second thing that's happened is this early wave of AI, I think people have really just been in use case discovery mode.

Jacob: Like, what can these models do? And to do that, they're using the most powerful brand name models they know. Now, over time, we're huge believers open source models will be big. We've seen people switch over to DeepSeek. But in the early days, a lot of people were using OpenAI and Anthropic. And so, it has been a little bit slower.

Jacob: Obviously data centers have been great places to invest in the inference market. Pat honestly has done some great investments in Modal and LiveKit. But I think this year actually is really interesting for infrastructure because as we start to see agents emerge we think there's gonna be some real common patterns in how agents access the web how they use tools and so this is an area we're paying a ton of attention to this year.

Scott: All right, the applications here. Alex, from about 98, 99, 2000 to about 2015, 16, 17, 18, it was an astounding transformation of the application landscape where we moved from package software and on-prem software to cloud software and represented it. Pretty spectacular opportunities for us as venture investors and for the entrepreneurs who are building these companies.

Scott: Then honestly the application phase, it just got long in the tooth. It was harder and harder for us to find interesting opportunities. It really started to run out of steam. Obviously with the advent of AI, there's been just an explosion in the number of companies that are actually building applications sitting on top of this stuff to try to deliver different experiences. I'd love for you to just, given your experience as a SaaS entrepreneur over the years, just talk a little bit about what you're seeing here now.

Alex: Yeah, I don't have the engineering brain that that Pat and Jacob do. And so they spend a lot of time in models and infrastructure. I swim at the application layer. For me, the last five years of innovation in the large language models and infrastructure are now finally going to come to a point where applications could take advantage of this and deploy it. I think it's scale, which is incredibly exciting. I lived through whatever, 20 plus years of operating.

Alex: I think the reason that when cloud first came to market, there was an opportunity to disrupt incumbents. Yes, there was a technology. There was a sort of technological shift from on prem into cloud. It was a different software delivery mechanism. But the other part of it that people maybe don't talk enough about, and I learned from, from Benioff, was the business model change.

Alex: It was the intersection of that business model change and the underlying technology that enabled new startups to disrupt incumbents. The same thing is happening now. In mobile, that wasn't the case. It wasn't really a business model change per se, but with AI, there is a business model change. It's a technology underpinning, but also you have these new models where you're charging for work rather than for a seat.

Alex: And so I think that creates again. That moment of disruption that we saw happen earlier on with SAS initially. Now, what's the implication of that? I think there's a lot of opportunities in two areas of applications. One, horizontal applications. And so, it's why we're invested in companies like Attio, which is going after HubSpot or Salesforce.

Alex: It's a vertical CRM that's AI native and has a bit of this business model advantage. Or companies like LevelPath, which is going after Coupa, again with an AI native approach. If these companies are able to be successful, or even shave away a part 1 percent of Salesforce's revenue is a multi hundred million dollar revenue company.

Alex: So if these, if these new startups are able to be successful, that is a very large prize. Now the challenge is going to be that these incumbents are really great companies. They're incredibly well capitalized, and they're also going to take advantage of AI. I do think the attack vector is going to be speed, because a lot of these big companies have more lawyers than engineers.

Alex: So like how fast can you adopt some of these fast moving underlying models and the business model disruption because the big companies are going to have to move to a hybrid. They cannot walk away from SaaS pricing when you have billions of dollars sort of wrapped up in that, whereas the new companies are going to move directly to that.

Alex: So I think there's a lot of excitement at the horizontal. You just got to pick the right teams and the right companies. The area that I think there's even more excitement potentially is in vertical markets, and we kind of started to touch upon that.

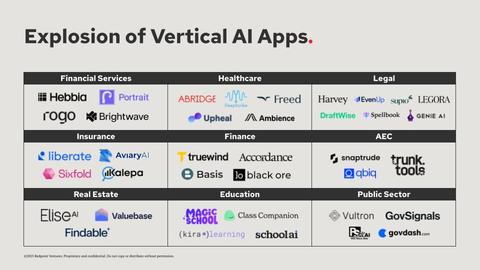

Scott: Yeah, let's hit on that. Enzo and Jimmy and some of the other members of the Omega team put together a database of all the vertical AI SaaS businesses that have been started in the last few years, and it's, it's, I think, what is it, 500, 600?

Scott: 500 companies. Like a cambrian explosion of companies here. Going after lots of different verticals in which there really have never been, I think, compelling SaaS solutions before. Talk a little bit about how we're navigating this. Like, this in many ways, there's some, clearly some examples like Viva and others have managed to build really compelling vertical software business, maybe ServiceTight and others.

Scott: But there's a big bet that's being made right now by entrepreneurs, by venture capitalists, that there are big companies to be built here. Do we buy that?

Jacob: Yeah, I mean, the funny thing is there'll probably be thousands more next year, right? I mean, people have only been building on GPT 4 for two years and these reasoning models since the fall.

Jacob: So there's gonna be a lot. And we look at a bunch of different markets. You know I don't think they're all, like, ripe for disruption. I mean, I think in, in many ways there's three kind of main questions we ask ourselves when we look at these. The first is, like, is there really an effective wedge into the market?

Jacob: I feel like people say you know product market fit when you see it, but there's some of some companies are growing so fast and have such, like, viral end user love that it kind of sets the bar high for the others. I mean, you probably all heard about experimental revenue in AI. It feels like any company's willing to try something.

Jacob: We're really focused on a wedge that that meaningfully works and is kind of flying off the shelves. Then I think the second question we always ask is, how much more can these companies do? You know, we'll see so many companies in some end vertical where they're replacing what one FTE does and it's like, cool, you can charge for that, but what do you go build from there?

Jacob: And how does that become a huge standalone company? Because, by the way, there's going to be eight competitors in the small category and eight competitors in the big category. So I think we're really focused on large industries like healthcare, law, finance where the prize is large and there's enough to go build from that initial wedge.

And then the third question that I think really matters is how much does quality matter? Because of that competition, somebody's gonna come in and undercut your price and, and price 50% with something 80 percent as good. And if that's good enough, then it's just gonna be a race to the bottom.

Jacob: And so, I think we're also focused on end industries and use cases where quality really matters. But it's hard.

Scott: Yeah. How do we think about market size here?

Pat: I think the, again, if they can unlock labor budgets, I think some of these markets that were traditionally not super attractive, maybe, or smaller than we would look for, single digit billions, they could start looking a lot more interesting.

Pat: There's some early indications of that, like in Liberate where the deal that Urvashi led they're starting to get much larger ACVs because they've been able to replace this human labor. But I think it's something that we look closely at and, verticals. Because I think a lot of them will be good businesses, but not kind of venture scale businesses that we're looking for.

Scott: Do we think there's gonna be a lot of carnage here? I mean, these are 500 going to 1,000, going to 1,500, going after increasingly smaller and smaller markets, increasing number of vendors in each one of these categories. What do we think happens here?

Pat: I think a lot of them will have great growth in the beginning and then probably top out as the markets become crowded and they're offering similar things.

Pat: I mean, we see companies, there's an AI call center thing and then there's 20 more of them in YC, and so I think, And they all have great traction. There's a lot of market demand, but I think that will run out. And then. Um, they'll either be a few emerging winners from that if the market kind of supports it or or their fizzle out.

Scott: Well, let me double click on something you said, Jacob, but you said that, hey, this 80%, is that good enough? Like, as venture capitalists, we're looking at market. How do we tell whether or not 80 percent is good enough? Well, how do we know the difference between a market where it has to be 100 percent quality bar or 80 percent is good enough?

Jacob: I think there's some probably things you can look to, right? Like regulated industries, for example, are great places to go hunt because you take an industry like health care. , there's probably some use cases where, like if you're treating a patient, you really want something that is best in class, but even take it aside. If you actually need best in class, imagine telling your and your patients. We use the 80 percent is good solution. There's 100 percent one out there that's best in class or we're the corporate law firm. And yeah, it was cheaper. So we took the 80 percent but red point. We're still gonna bill you the same and so I think there's there's certain industries that are probably more predisposed to that. If anything, though, I think one of the ironies of this first wave of apps is yeah, The easiest budget to go after is stuff that's already outsourced to like BPOs. But it actually is probably the worst for this because someone has already decided.

Jacob: Hey, I'm willing to make a quality trade off. Like I will take something way cheaper and lower quality. And if they're willing to make that trade off with labor, they'll probably make it again on the on the upside.

Scott: Any other comments on that? It seems like if we could have gone back to 97 and we were looking at the early days of the internet and investing, we could have gone to put up a chart here that looked at what the commerce landscape looked like.

Scott: And for every single vertical, there were X number of startups. And ultimately, we know that there was a ton of attrition and some consolidation around a handful of names that executed extraordinarily well. And I think we kind of expect that in many ways, that's what it's going to look like, at least in terms of where venture dollar returns aggregate.

Alex: Yeah, Raney, that's sort of the question that I'll add, and you know, I don't know the answer. If you look at SaaS, historically in a particular market, there became a clear market winner. And a disproportional share of enterprise value accrued to the market winner.

Alex: It is not entirely clear if this will be a market winner, kind of winner take most scenario in these markets, or they're just going to be incredibly fragmented because a lot of the value is being created by an underlying LLM and a lot of companies can sit. On that underlying LLM sort of and you've got to figure out like what is the line of innovation that the company is delivering and how hard is that to replicate?

Alex: And how do they get into that tent pole position to take most of the market.

Scott: I don't know if it's next or not, but we're going to talk a little bit about what we're looking for. But I guess as you kind of articulate that. Then it seems to me that one of the things we've talked about is velocity, and we've talked about companies be able to move really quickly, innovate very quickly.

Scott: Part of that implies that ultimately they're just going to be able to out move, outflank a bunch of different competitors and ultimately move into adjacencies and create some big that we're actually expecting with some of these investments we're making that they actually will, they'll be able to resist this kind of tendency towards fragmentation again.

Scott: How do we figure that out? Like when we're looking at these things, how do we determine that between the companies that have an opportunity to build something that can be a big standalone business versus one that likely it's going to flatten out at some point based on competitive dynamics.

Alex: I'll sort of jump in from an early perspective. At the earliest stage, we just don't have a lot of data. Um, and so, we've seen sort of, I think, I'm oversimplifying this, but like, two types of founders, because at early, we really index on founders. One group of founders are these young, great builders who move super fast, to your point on velocity, but don't have a lot of experience in the market.

Alex: They're going after, they just saw an opportunity, and they're building fast toward that opportunity. And they might have first mover advantage. And then there's another group of founders that have what we call founder market fit, which is like their collective set of experiences that gives them a unique insight point of view on how to solve the long term market problem.

Alex: And so we typically index to the founders with founder market fit. So you know that one of the companies we talked about Motif is co founded by the former co CEO at Autodesk. They're building an AI native Autodesk 2. 0. And so that's a bet I'm willing to take without much sort of other data.

Pat: The other thing I'd add from the early side is we look for [00:26:00] significant product depth or something that would be challenging for another team to come replicate, and so I think Motif is a really good example where they're building Autodesk in the cloud.

Pat: Obviously, AI will be a piece of what they're doing, but their solution is probably 80 percent workflow, 20 percent model versus 80 percent model, 20 percent workflow. Um, and I think that makes a big difference on how hard it is for someone else to replicate it.

Scott: If we, if we look at a handful of companies we know that are having some success, what do we think are some of the common characteristics to these businesses?

Scott: I mean, I think some of it you kind of touched on right now, Pat, but curious what conclusions can we draw from some of these businesses?

Jacob: Yeah, I mean, I think the, the first thing that I've just been really struck by and over the last year is The degree to which first mover advantage matters and how fast you can get it.

Jacob: I mean, the, the idea that in six, nine months, a company can just become synonymous with a category. If you ask someone on the street in San Francisco to name a healthcare AI company, like they'll probably name a bridge. There's a bunch in other categories too. And that's really hard to compete against because You get in the room with every single customer.

Jacob: and you're kind of you become a default really quickly. And then partnerships come your way. Interesting opportunities on the model side capital and so I think that at the early growth stage, it's trying to find that a half step early when we think someone's kind of getting to that position.

Jacob: You know, velocity. We've talked about ad nauseum, but it is really important. And then ultimately, when we're comparing these products everybody wanted there to be some, like, grand. We talk about moats in apps all the time, and we always wanted there to be some crazy moat. Like, oh, they have this data asset nobody has, and that means their models way better.

Jacob: It turns out. I don't really think that stuff matters that much. And ultimately, The mode ends up being the thousand little things like the UX, the breadth of the product the kind of you know, experience using it that make a SaaS product better than another. Um, and so I think in many ways it's actually been quite similar to SaaS in terms of what we've been looking for.

Alex: I totally agree with what Jacob just said, it does feel a little bit like driving in the fog with some level of visibility. And you don't know if it's 10 feet or or 50 feet, because I'll sort of reference 1 of the slides Logan put up previously, which is sometimes it's not being 1st, it's being last that matters.

Alex: Google was not the 1st search engine and Facebook was not the 1st social network. And so we'll see how these things play out. What we see in front of us today, Jacob's absolutely right. That's that's where he placed the bet. But we'll see what time says.

Scott: I double click on something that you brought up, which is domain expertise versus AI expertise.

Scott: And you gave your point of view, which is you've tended towards domain expertise. Jacob, how do you think about that? When you're when you're looking at a founding team, what how do you how do you think about the relative importance of AI expertise versus domain expertise?

Jacob: Yeah it's, it's interesting.

Jacob: I feel like in the beginning of this wave, everyone was like, oh, we want the former DeepMind researcher on the team or someone from OpenAI and, and I think increasingly we're like, that doesn't matter. Like, I think it's important to be technical insofar as you have your finger on the pulse of where the models are going.

Jacob: Because with the pace of these models, it's like every 36 months, there's like an extinction level event for your company, potentially. Like if you're, if reasoning models come out and you're not the one to bring them to your customer, but somebody else is going to do that. And so you have to have your finger on the pulse, but you don't need to like be the one making the reasoning models.

Jacob: And then on the domain side, I think it's important insofar as like you can understand and user problems. But I feel like it's never been a more democratic moment in these vertical markets where like, I mean, I've been investing in healthcare for a while. Like it used to be, you know. 10 people that could get in the room with, like, the hospital CEOs that matter.

Jacob: Now I feel like almost anybody can if they've got, like, a good AI product. In in some ways you know, I think the domain expertise really just matters to understand the problems

We should be backing or the folks that just so deeply know an industry Um, ideally we like a combination of both kind of cop out answer.

Scott: There's a bunch of companies that I think we could point to and we just didn't want to put the logos up here that have had some, a lot of early success, but then kind of hit a wall. And it's happened shockingly quick within the landscape. What can we learn from some of those? Those businesses?

Pat: Yeah, I think they we kind of touched on it before, but I think they were. Easy to replicate and easy to rip out the, the highest level. Um, and so there was a lot of AI tourists, right?

Pat: Everyone wanted to try the latest and greatest. We saw this with the AI SDRs, everyone's implementing a new SDR every day to try something that's going to have a better impact on customers. Um, and I think that. You know, because they weren't a very integrated solution, or there wasn't a lot of gravity to what they've built, then a lot of those ended up getting ripped out to the next latest and greatest.

Scott: I mean, one of the things I think we at Omega have had to be very careful about is experimental budget versus Business line budget. I mean, one of the things that tell you is that to your point, it's not hard to get in front of a buyer today with an AI product because every one of them has been told by the boss that they need to be thinking about how we're going to leverage AI to transform their business.

Scott: And so there's a lot of kind of experimental budget being being thrown away, thrown around. And then ultimately, when it comes down to it, does that translate into kind of like being able to secure business line budgets and extend that into other companies? So how do we and omega navigate that?

Scott: How? How do we determine whether or not this feels like durable revenue or not?

Jacob: Yeah, I mean, the the users never lie, right? Like, if you talk you have some of these companies that are scaling fast. And if you talk to the end individual user of them, you can usually tell, like, is this something that we're just messing around with it?

Jacob: You know someone up top one of the sees it. I think from a metrics perspective, like Honestly, engagement and usage ends up being, you know, even even a greater sign for us in, in many ways. And so I think that's what we just end up being super focused on.

Pat: The only thing I'd add on the early side is we see so many companies with meaningful traction now.

Pat: Um, the benchmark six years ago was always a million in ARR, right? That was zero to a million. That was a great kind of traction for a series A. And now. A lot of these AI companies have gone 0 to 3, 0 to 5, 0 to 10 in some cases and it doesn't necessarily mean that there's a lot of gravity to what they have there.

Pat: Yeah. I mean it's Now if it's 0 to 1, it's like, what happened? Yeah. Yeah, there is some truth to that.

Scott: I mean, it's, it is It's really incumbent upon us to dig a little bit deeper here and not get wowed by the numbers because it, in some cases, it would be easy to be swayed by this. Alex, anything you want to add here?

Scott: Nope. All right, let's transition to, we talked a little bit about startups versus incumbents, and I think that one of the things that you mentioned, Alex, is that incumbents have customer relationships they have. They own a lot of workflow already. They have a lot of proprietary data that they could be using to fine tune models and customize things.

Scott: Deliver really. Targeted experiences, and honestly, every one of them is recognizing how important AI is going to be that telling a story. I mean, look at what Logan presented in terms of the way in which companies are being valued in the public markets. If you don't have an AI story, you're trading at a discount, right?

Scott: So how do we navigate that? Like let's take a couple examples of spaces here.

This customer service, the sales and marketing, there's finance. These are all areas that. I've seen a lot of venture dollars flowing to some really compelling companies here. Um, but there are very strong competitive incumbents.

Scott: In fact, like salesforce and agent force, that's been a very successful product launch so far. Um by all accounts, it's, it's and I think mirror's husband's busy working on, on trying to put a lot of our businesses, our companies out of business at salesforce. But sharing is successful, but.

Scott: It's been a very successful launch so far. So are we confident that startups are going to be able to displace, in many cases, and eat into the incumbents in meaningful ways?

Alex: Yeah, I mean, I think confident is maybe a little bit of a stretch. We're trying to figure it out. I mean, there's the famous adage, Will incumbents gain innovation before startups gain distribution?

Alex: And there's certainly such a Distribution advantage for a company like Salesforce. Um, mark is very good at marketing the future. It was a big part of our salesforce dot com became salesforce dot com, and he made salesforce synonymous with the cloud. And now he's making salesforce synonymous with agents with with agent force.

Alex: The story is excellent. The reality on the ground is somewhat disconnected from the story of the quality of the products. I've talked to a lot of people who have used the products. They're not that great yet. Um, will they get better? Absolutely. And Salesforce is going to. Put a lot of capital behind ensuring that happens.

Alex: That having been said, they still have like a systemic problem, which is they sit on old databases on old infrastructure with a terrible old UX that they cannot change using a I. And so you're putting a I into a system that has structurally Workflows developed 20 plus years ago, and I think in today's world, people are going to rethink exactly what that looks like.

Alex: I'll just give you one example. That's like so many degrees down that maybe obtuse for people, a big part of in customer service. The brain of a customer service system is called a routing engine. A routing engine is something that takes a lot of logic in to understand what should I do with this interaction when it comes in?

Alex: What channel did it come in on? What's the importance of the? question that's coming in on that channel. What's the value of the customer who's available on the other end to be able to respond? All of that is a very complicated system that is built with like thousands and tens of thousands of lines of code.

Alex: That is basically a logic tree. You can completely eliminate all of that using AI to make a much better decision of what to do with an interaction and where to move that interaction. Like, Salesforce has to engineer out things like that out of their entire product to get to a place where they can have a ton of velocity.

Alex: And so, does that make them vulnerable in some way? I think so. Um, are they going to be a going concern a decade or 20 years from now? Absolutely. But are startups going to have an opportunity to cut into Parts of Salesforce. Salesforce is now 10 products, by the way. They're, they look more like a private equity firm than innovation firm.

Alex: And so I think there's opportunity, but the incumbents are incredibly strong and we should not take them for granted.

Scott: I think one of the things I've heard you say is the more the workflow changes, the better opportunity there will be for That's exactly right. So walk through that a little bit. What do you, what do you mean by that?

Alex: Well, I mean, it sort of just goes to the point that I, that I made, it is like, what is the logic, the, the input and output and the logic in the middle that was used to generate. You know, sort of the delta between those two. AI is taking on a lot of that logic and is actually able to do it better. Because it can bring in a lot more data that you didn't have access to in the past.

Alex: Like in that routing engine, you couldn't have pulled external data to say what's happening with that particular company, or what's happening in the market to inform the decision that we make. Now you can. , and for Salesforce to like, again, remove that, that's like heart surgery. Because they have thousands of customers using that product.

Alex: That have put tens of thousands of hours into engineering our product to do the thing that they need to do. Whereas startups don't have to deal with

Pat: that. Maybe an example of where the workflow doesn't change. We saw in the early wave of AI startups, there was a bunch of AI native notions or PowerPoint generation with AI.

Pat: And I think those are two cases where the workflow doesn't change very much. You can generate what you were looking for kind of in, in line with the products that already exist. And so I think the AI native PowerPoint platform is probably Google, right?

Scott: Wasn't a big enough change to get an opportunity for startups, even though in the end, it can be a There's a magical product experience that's enabled through AI, but it's possible that the incumbents can deliver that.

Pat: Yeah. I also think, to this slide, I think the loser right now is actually not on the slide, which is the BPOs and the legacy services businesses. And both the startups are eating into that. They're obviously on a collision course, but I think that's where a lot of the budget's coming from.

Scott: Yeah. And that's clear that we're banking on a lot of the returns going to come from.

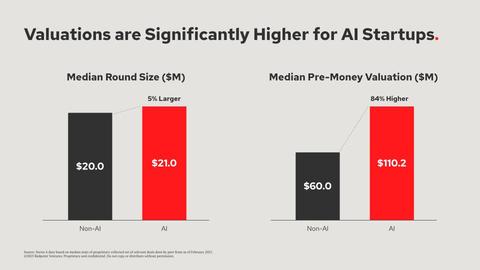

Scott: , all right, let's change gears here. So valuations been we've talked about it, I think, in multiple different presentations today, but the AI valuations are, are high. This is our proprietary data set for series A's. So Logan, I think you presented something for series B's and series C's. But for series A's, we see slightly incrementally larger round sizes for series A's, but we're seeing substantially higher valuations.

Scott: , pre-money valuations the same trend holds for what we're seeing in Omega. How do we, how are we navigating this? What does this then imply in terms of our ability to deliver really good returns to everybody out here in the audience?

Alex: Yeah, I mean, I think we're, we're learning every day. First of all, the fact that, that valuations are higher for these AI companies, I think is understandable based on everything that we've talked about.

Alex: This belief that markets are going to be bigger, that these companies are going to be able to access labor. Markets that they're gonna be able to access verticals that historically, maybe they didn't in the same way. And so you can underwrite to much bigger outcomes. Logan sort of presented earlier the speed at which these companies are also growing.

Alex: It's just, it's unbelievable how fast some of these companies that really catch on and become synonymous with the market can grow relative to companies that have in the past. And so this makes all the, I think, logical sense as to why the game is playing out on the field this way. The other thing that we haven't really talked about is, The prediction that Pat made, which I think is right, AI companies are not only just going to deliver an AI product to their customers, they're going to embrace AI natively to be able to build that product much more efficiently.

Alex: And so we will see companies. That have hundreds of millions of revenue and have billions of dollars of enterprise value that have 20 employees, 30 employees, 40 employees. The implication of that is they might have to raise less future capital. So even though the initial few rounds are going to be more expensive and more capital, they may never come back to the well for a series C, D, and E like they have in the past.

Alex: Because they're going to be able to run really profitably, especially with the cost of AI dropping. And that helps because we dilute less, obviously, than we have maybe historically. So, I mean, I think the challenge is One, picking the right ones because you're not going to be upset about paying 110 million valuation if you're in the right company.

Alex: And two, what we touched upon earlier, which is these false positives, these companies spiking really quickly and trying to use that as a signal for, is this going to be an enduring company? And that I think makes it really hard today.

Scott: Anybody want to add anything?

Jacob: Yeah, I mean, I think, you know the valuations are high.

Jacob: We're seeing a lot of preemptions. The market's pretty crazy. Um and I, and I think for any company we look at normally at the price point that we look at with these AI companies, the AI companies come with a lot more risk. They just do like the market's changing so fast. , and so I think obviously I totally agree.

Jacob: Like you're not going to be mad about being in the right company. Um I think honestly, on a mega one thing we think about a lot is just, yeah. It needs to be a really tail opportunity like there's so there's such a temptation to go after like vertical markets like 21 through 50 and you're kind of taking on the same amount of risk because there's going to be eight competitors that come in.

Jacob: , and so I think I think part of picking the right companies for us has been also picking the right end markets where there really is just a massive tail opportunity if it works.

Pat: Yeah, I think this. This is honestly the hardest thing to navigate. And I think we spend a lot of time debating this back and forth.

Pat: And obviously in the early side, I'm sure on Omega too, it's. Um exciting companies, but I think it's challenging to build a portfolio at some of the prices that, that they're raising. Um, so it takes a lot of nuance to figure out where the right ones are.

Scott: Yeah, one thing I didn't fly on the Omega side is not just that they're raising higher prices, but they're coming back far sooner than you normally seeing.

Scott: So they feel. Even that much more expensive. They're not too expensive. They're really 3 or 4 X is expensive on a multiple basis. So you know, it's back to what Jacob said. It's critical for us to make sure that we focus on on those that we think can build really big businesses, which means that we've been pretty really an omega.

Scott: We've been pretty. Um not conservative, but we've been haven't been making that many bets. We've made a few. Fortunately, they're working out really well. Um, but it's been, we've had to be really circumspect about how we've approached investing here.

Alex: Yeah, I'll just sort of maybe add two things because pat touched upon it.

Alex: I think you did too rainy just now, which is this impacts fund construction. If you think about getting enough shots on goal and getting sort of enough ownership and you're paying more for that. That, that impacts fund size and how you think about it. The other thing is you just have to be incredibly disciplined and it's hard because with discipline you're going to miss great opportunities.

Alex: The stock came to my head because I was thinking about one company that we looked at that went from 0 to 8 million of ARR in their first year. Now a lot of that was concentrated in one customer, but that's just incredible growth. They did it with 10 people. The first financing outside of the seed round, which was like a 5 million seed.

Alex: And when they went to raise that 7 million on the balance sheet, cause they didn't need the capital, was like a 40 million financing at a 400 plus million dollar valuation. The thing that sort of came to mind out of that is the revenue maturity of that company was completely incongruent with the maturity of the company, right?

Alex: Because in the past, to get to 8 million, there's a lot of other things that would have happened in building the company to get to that scale. Systems, people, process, like none of that is developed in this company. They're eight months old. And so you're taking a greater risk on like a lower level of corporate maturity relative to revenue maturity.

Alex: And they've got a. Like navigator

Scott: being asked to pay the valuation that that it's associated with a million, but the company is not nearly that mature, which is exactly 1 of the things that we've done to respond to that is that we're coprocessing more deals than ever right now between early and Omega, because we're seeing a lot of these companies that are honestly raising bigger rounds with some level of traction.

Scott: But they're the first institutional round, really. And, and so it's made sense for us to partner up on a lot of these. And I think you're going to see us doing a number of investments where both funds will be investing simultaneously as a result. So we think about building portfolio construction.

Questioner 2: Um, for much of venture, like the last several decades, revenue has been a lagging indicator. Um, and now like there's a difference between revenue traction and company building. So is revenue now. A leading indicator, a misleading indicator.

Questioner 2: And are we going to have a bunch of like 50, 60 million revenue businesses that are actually early stage? They don't have CFOs. They don't have like the nuts and bolts in place for actually building a company as opposed to just a really well monetized product.

Pat: Yeah, I think this is a really good question.

Pat: And this kind of gets to what Alex was talking about. I think, um. We are going to see some immature companies reach very meaningful scale, right? And we're already seeing that. And so there's obviously all the considerations that go along with that in terms of valuation and. Um, and when we want to come in, but yeah, I think, I think we'll definitely see that

Scott: a 50 million SAS business is very different than a 50 million AI SAS business on a 1 is the maturity of the business that companies and businesses, these things are growing faster, and they don't have a chance to grow that up.

Scott: But 2 we have to make sure building 50 million in SAS revenue is the result of a lot of. Hard work and business justification and going through detailed process of your customers, delivering exceptional products, delivering great customer success, helping grow those accounts. I mean, there's a lot that goes into that right now.

Scott: It's possible to do that without actually having mastered any of those things and. Um, and that's why we were saying that we have to make sure that when we see 50 million of revenue that are AR, that we really believe that that is indicative of the ability for them to continue to do that going forward.

Scott: It's a lot of work that's involved with that, and kind of lends itself to the stuff that I think that we, as a firm do really well, which is a lot of first principle diligence work and not getting caught up with the hype, but focused on kind of core fundamentals, these businesses.

Scott: But, yeah, that's, that's exactly one of the things we're wrestling.