It’s no surprise that the venture market has cooled in the past year (well, if you’re not an AI company at least). In Pitchbook’s Q2 venture report, JP Morgan estimated nearly half of all Series As and Bs this year were insider led bridge rounds, and Q3 saw the lowest number of ventures dollars in 6 years and lowest deal count in 3 years. The data implies that raising a round requires greater traction and stronger performance to stand out than ever before.

A few months ago we held our first ever Redpoint CEO Infrastructure Retreat. It was an opportunity for our Infrastructure Founder CEOs to meet with one another and share learnings across their experiences, and we held several workshops taught by leaders in the field across various areas of startup building.

One workshop that I ran for our companies was around Series B financings for developer tool and infrastructure startups in this current environment, and what it takes to raise a successful B. Given the amount of inbound I received from my past post on open source fundraising metrics oriented toward Seed and Series A rounds, I figured this might be something founders outside our portfolio may find useful.

I took a data oriented approach to determine what a best in class Devtool Series B looks like right now. I surveyed 16 friends of Redpoint who invest in this sector and stage to gain a better understanding of their expectations for companies raising such rounds, and aggregated data across the responses for the following categories:

- Revenue Expectations

- Burn Expectations

- Metrics that Matter - what are the most important metrics to focus on

- Efficiency or Growth Expectations

- Dilution and Valuation Expectations

- GTM Team Expectations

Before I dive into the results, I want to caveat that these are simply datapoints. Many firms that completed the survey noted that these are definitely not hard and fast rules, and everything is a case by case basis. You could achieve every metric here and not raise a successful B, or be below them and achieve a great financing. It is also worth noting that the questions were framed as what is best in class, not the average.

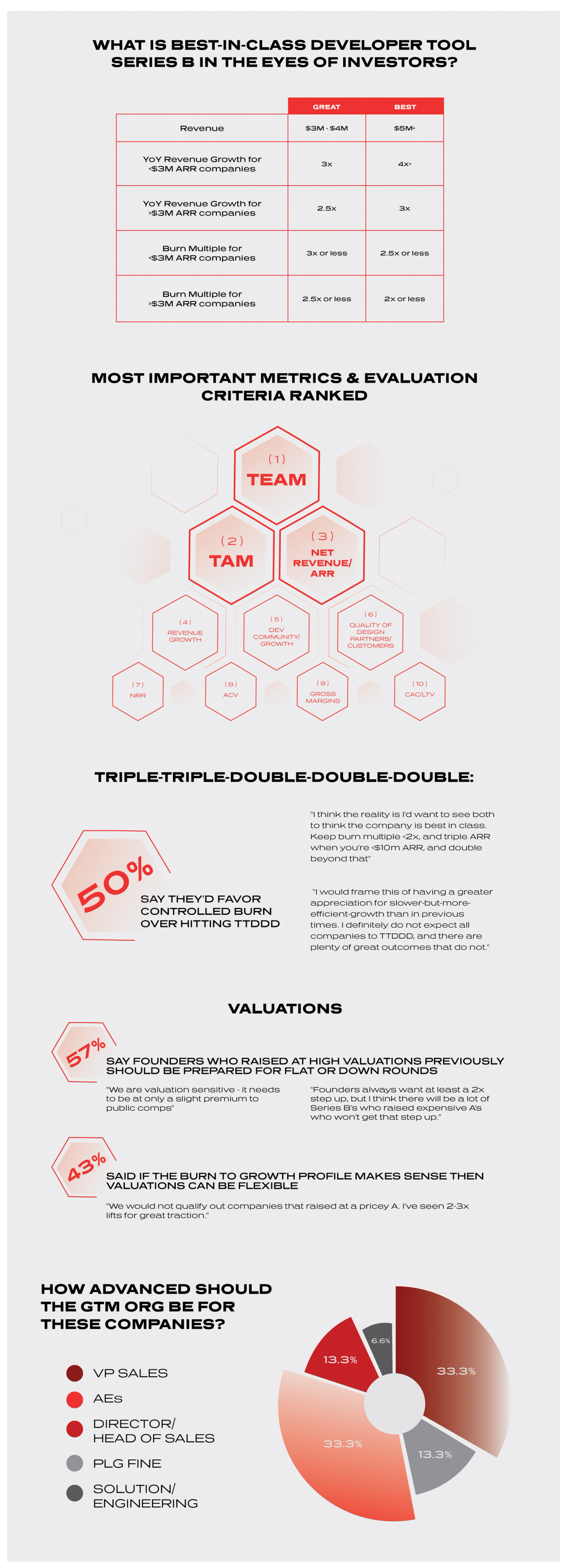

With that, let’s summarize the profile of a “best-in-class” developer tool Series B raise in this market environment:

I wish it were easier, but unfortunately there are still quite high expectations for companies raising a Series B. However, before you start comparing your company’s metrics to those listed here, take a step back and answer the following:

- Have you found PMF?

- Is there evidence of a repeatable GTM motion?

- Are you solving a critical painpoint that people are excited to pay for?

As described in the image above, the top 2 criteria investors care about are Team and TAM, not operating metrics pertaining to revenue or costs or margins. Don’t underestimate a strong team and a compelling story around your product and how it pertains to a large market; even without hitting the benchmarks listed here, you’d be surprised how far you can go :)

For a question-by-question deep dive into the full dataset of responses:

Revenue Expectations:

Revenue Targets:

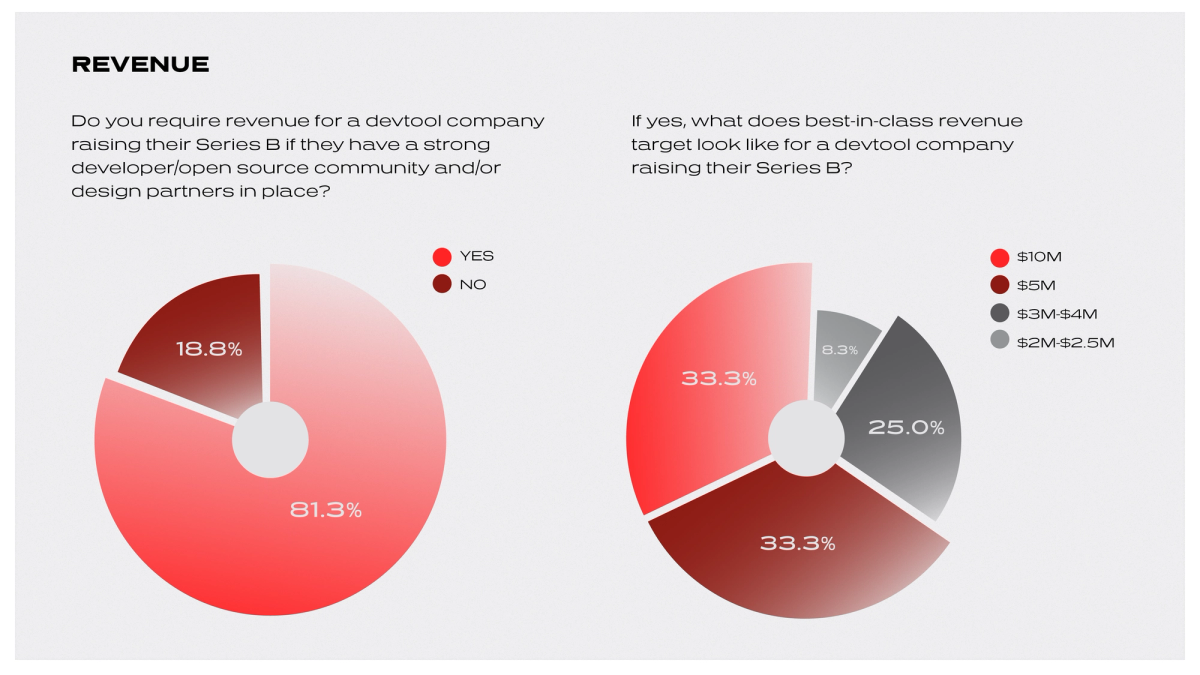

Question: Do you require revenue for a devtool company raising their Series B if they have a strong developer/open source community and/or design partners in place?

In my last post on open source fundraising metrics, the data showed that historically many open source companies could raise a Series A without revenue, but that revenue was a requirement for the B.

Unsurprisingly, the data revealed this was the case for Series B devtool companies in this market environment. 81% of respondents required revenue by the B, while 19% were accepting of strong communities/design partners in lieu of revenue.

Question: If yes, what does best-in-class revenue target look like for a devtool company raising their Series B?

33.3% of respondents said $2M-$2.5M, while another 33.3% said $3M-$4M, implying that you are likely in a good position if you are in the $3M-$4M range.

Revenue YoY Growth:

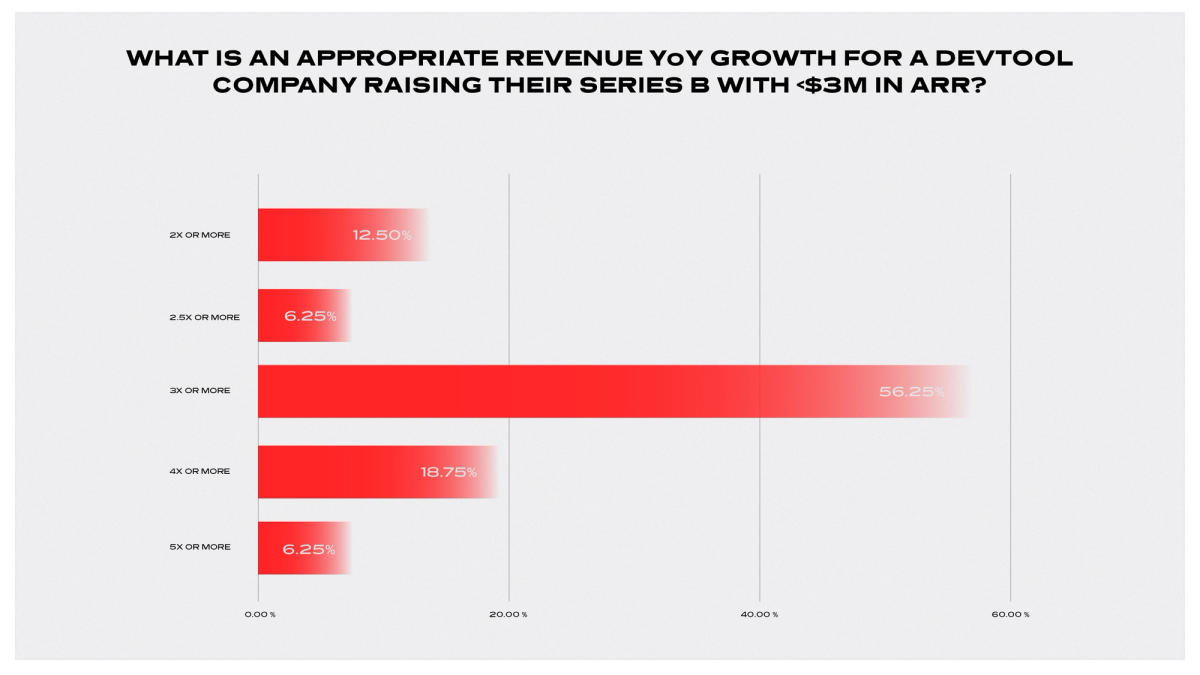

Question: What is an appropriate revenue YoY growth for a devtool company raising their Series B with <$3M in ARR? Does your answer change at all if it has a strong developer community/Open Source community?

For companies with <$3M ARR, only 19% were comfortable with <3x revenue growth. When asked if their answer changes at all if the company has a strong developer community or OS product, answers were split evenly down the middle. 50% said no, with one response stating that a “strong developer community/OS product should be an amplifier not a detractor to growth”. Meanwhile, 50% were comfortable with a less steep revenue curve, provided that the free tier of the product has a direct connection to pipeline, if the community is growing, and if the category is commercializable.

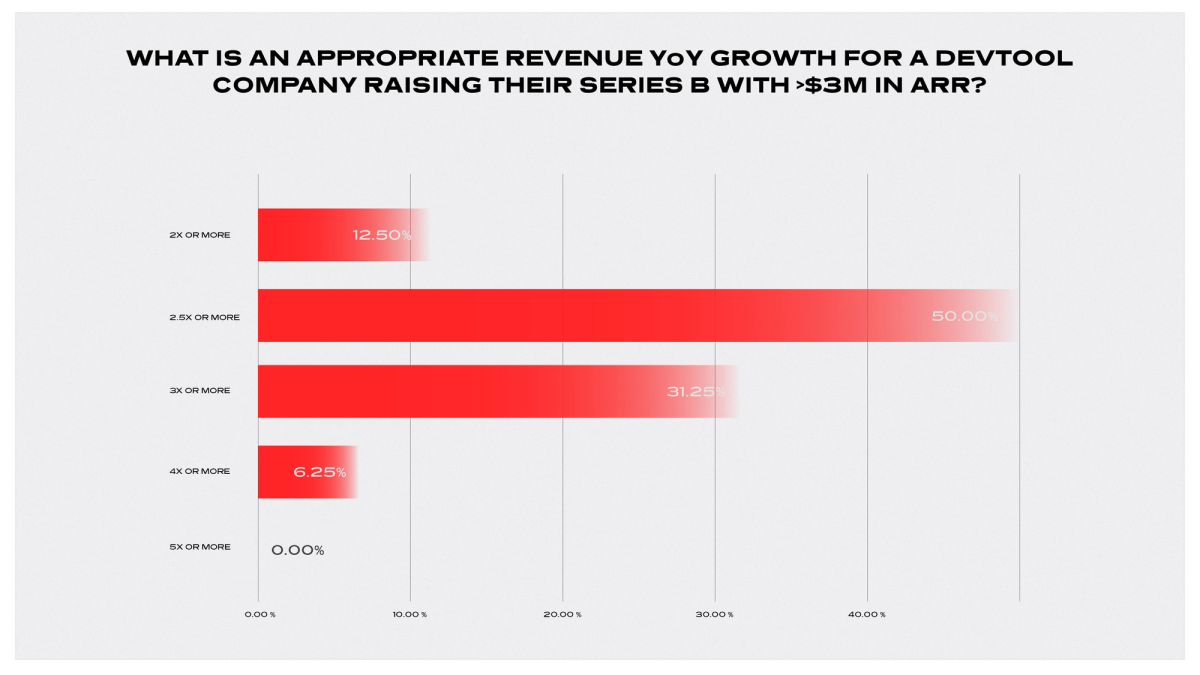

Question: What is an appropriate revenue YoY growth for a devtool company raising their Series B with >$3M in ARR? Does your answer change at all if it has a strong developer community/Open Source community?

When asked the same question for companies >$3M ARR, we see the number of respondents accepting of <3x revenue growth increase from 19% for companies <$3M ARR to 63% for this group of companies, implying that investors are more willing for revenue growth to lessen slightly once the company has achieved a few million in ARR. When asked if their answer changes at all if the company has a strong developer community or OS product, answers remained split evenly down the middle.

In general, founders should aim for a 3x revenue YoY growth multiple to be safe, with a contingent of investors being more lenient if you have a strong developer community to compliment your GTM motion.

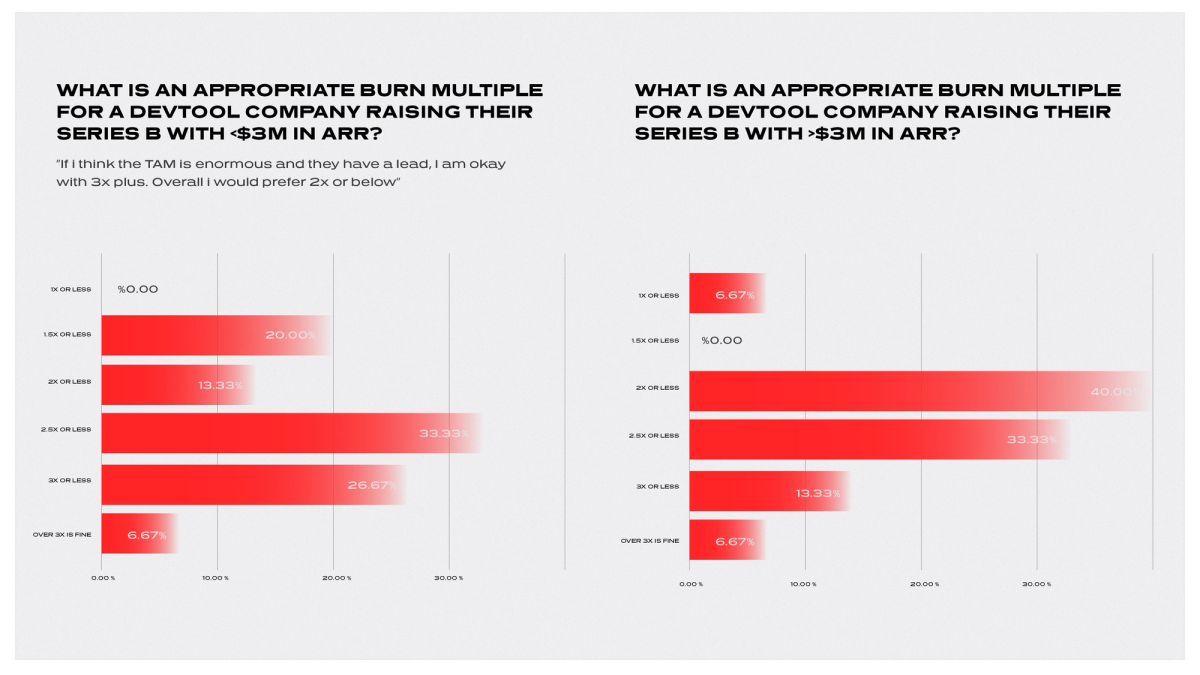

Burn Expectations:

A burn multiple is defined as your net burn divided by your net new ARR. Again, I divided the questions into companies with <$3M ARR and for those with >$3M ARR:

Question: What is an appropriate burn multiple for a devtool company raising their Series B with <$3M in ARR? Please check all that apply.

For <$3M ARR, we see 66% of respondents desire a 2.5x or less burn multiple. Nearly all respondents were reluctant of burn multiples >3x.

Question: What is an appropriate burn multiple for a devtool company raising their Series B with >$3M in ARR? Please check all that apply.

When we compare this to >$3m ARR companies, we see 80% of respondents desire a 2.5x or less burn multiple instead of 66%, implying that as a company scales in revenue investors would like to see a more controlled burn ratio and efficient growth.

Metrics that Matter

The goal of this section was to determine which metrics founders should focus most on optimizing and presenting a story around for their Series B.

Question: Rank the following metrics in order of most important (#1) to least important (#10):

- Net Revenue / ARR

- NRR

- ACV

- Quality of Design Partners/Customers

- Revenue Growth

- Gross Margins

- TAM

- CAC/LTV

- Dev Community/Growth

- Team

Let’s analyze the results across a couple of different vectors.

First, if we look at the number of times each metric was listed as the #1 most important, we see that Team (44%), Revenue Growth (19%), and TAM (19%) were scored the most often. Looking to the number of times each metric was listed #2 most important, we see Team (50%), TAM (19%), and Dev Community/Growth (13%) chosen most.

Second, if we look at the median score of each Metric, we get the following results:

- Team: 2

- TAM: 3.5

- Net Revenue/ARR: 4

- Revenue Growth: 4

- Dev Community/Growth: 4

- Quality of Design Partners/Customers: 4.5

- NRR: 6

- ACV: 7

- Gross Margins: 8

- CAC/LTV: 8.5

It’s clear from both analyses that Team is by far the most important metric Series B investors use to evaluate developer tool companies at this stage, followed by TAM. After that, revenue related metrics such as Net Revenue/ARR and Revenue Growth lead the pack with respect to performance oriented metrics, followed closely by Dev Community/Growth. While other metrics like NRR, ACV, Gross Margins, CAC/LTV, and others are still looked at, they aren’t as important criteria.

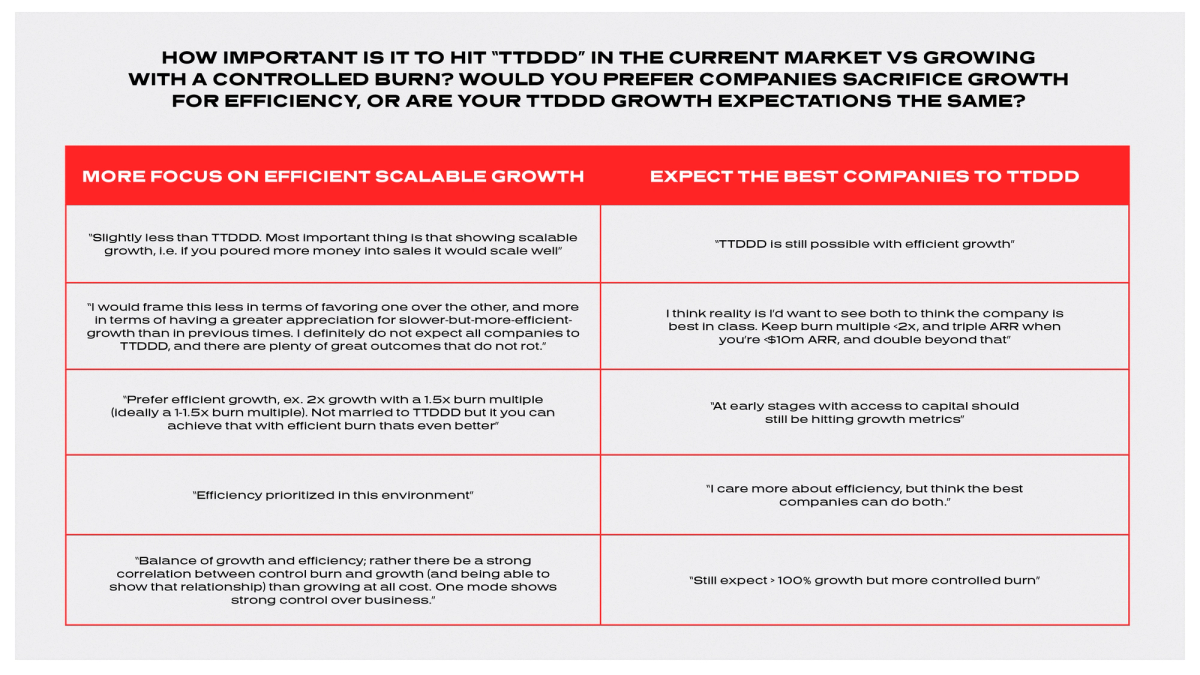

Efficiency or Growth at All Costs?

There is a common mantra in startup land of “triple triple double double double” of a startup achieving $100M ARR by tripling in the first year (e.g., $2M to $6M ARR), tripling in their second year ($6 to $18), and then doubling each year afterward to hit the $100M milestone in 5-6 years. Often VCs look for startups exhibiting this growth curve when evaluating best-in-class opportunities.

However, is this true in the current macro environment when budgets are being slashed and growth is more difficult to achieve? Let’s take a look.

Question: How important is it to hit “TTDDD” in this current market vs growing with a controlled burn? Would you prefer companies sacrifice growth for efficiency, or are your TTDDD growth expectations the same?

Investors were largely split down the middle, with roughly 50% being fine with slower growth if the companies are demonstrating highly efficient growth, with the remaining 50% demanding the same growth rate expectations today as they did in prior years.

For those accepting efficient and scalable growth, comments focused on wanting to see a strong correlation between controlled burn and growth (e.g., if I poured $X into marketing/sales I’d get back $Y) and an acknowledgement that not all great companies will achieve TTDDD. For the other side, not only did investors still want to see TTDDD, but they also wanted to see it done with an efficient burn rate - talk about needy investors! :)

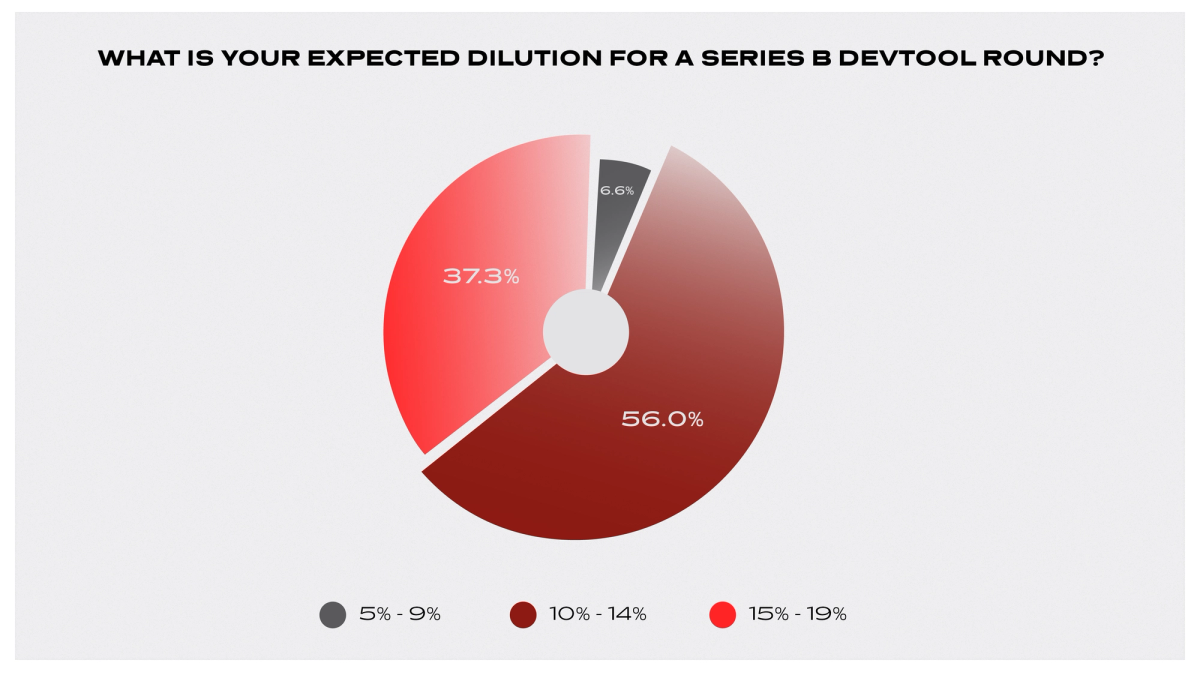

Dilution and Valuations

Question: What is your expected dilution for a Series B?

Dilution expectations were fairly uniform, with the majority (56%) being in the 10-14% dilution range and nearly all respondents answering somewhere in the 10%-19% range:

Question: What valuations are you seeing for Series B devtool companies? If too broad, what about a company going $2M to $6M ARR?

Actual valuations were incredibly diverse. Most answers indicated a roughly $120-$200M range with some stretching to $300M, though some respondents had truly large ranges (e.g., $200M-$700M) depending on how “hot” the company and space is.

Question: Do you have a rule of thumb for valuation increase from the Series A? Would you qualify out companies that raised a really high priced A relative to traction?

This one unfortunately may sound bleak to a lot of founders reading this. 57% of respondents mentioned they were valuation sensitive and that founders should be open to a flat or down round. They mentioned that founders have historically gravitated towards at least a 2x upmark, but that the expectation should be that would be the max going forward today that many will not receive. Meanwhile, the remaining 43% indicated little concern, saying that valuations are flexible in this environment if the burn to growth profile makes sense.

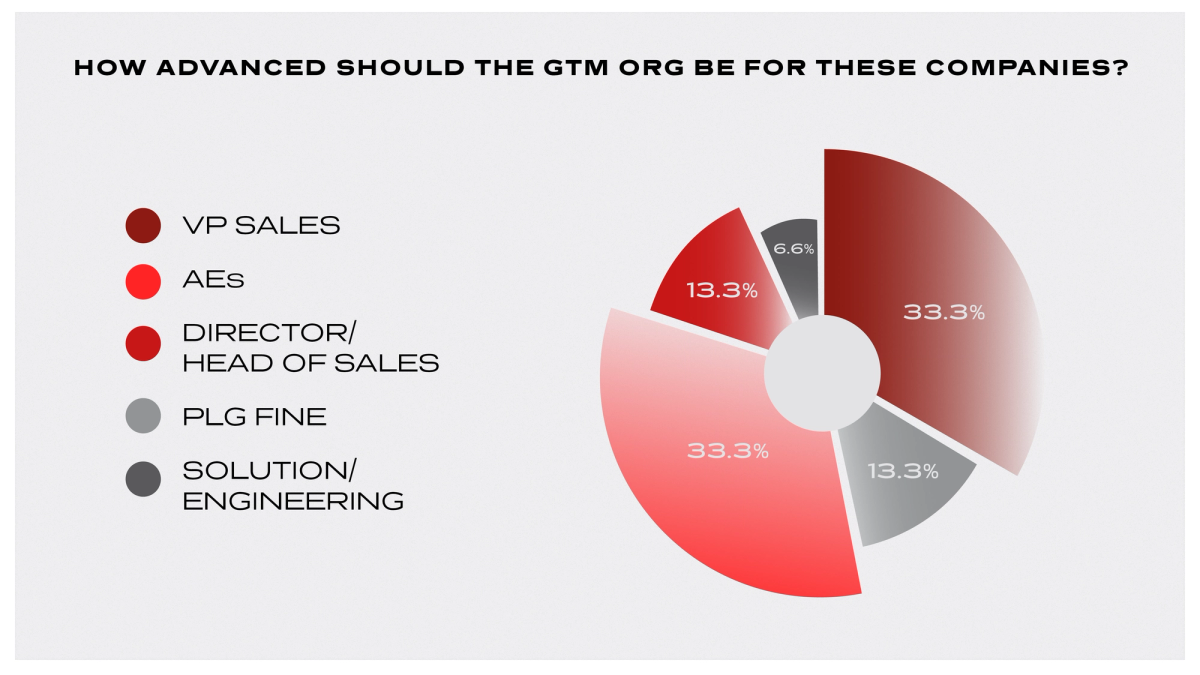

State of GTM Team

A question we often get from Series A developer tool companies is how they should grow their GTM org and what positions they need by the Series B, such as AEs, Solution Engineers, a Head of Sales, or VPs.

Question: How advanced do you expect the GTM org to be for these companies?

When asked what the GTM team should comprise at the time of the Series B, the majority of respondents cited having AEs and either a Head/Director of Sales or a VP of Sales. Respondents varied with respect to not needing VPs versus wanting to see full fleshed out exec teams with multiple VPs.

That was a lot of data! I hope this was some helpful framing for folks as they prepare to navigate their Series B raises in the market environment. If you have any questions at all or want to chat, follow me on Twitter @jordan_segall !

Thank you to Jamin Ball at Altimeter, Saanya Ojha at Bain Capital Ventures, Danel Dayan at Battery Ventures, Brittany Walker at CRV, Tobi Coker at Felicis, Jason Risch at Greylock, Bryan Offutt at Index, Shravan Narayen at IVP, Feyza Haskaraman at Menlo Ventures, Grace Isford at Lux, Rajko Radovanovic of NEA (now A16Z), Elaine Dai of Norwest, Sai Senthilkumar of Redpoint Growth, Max Abram of Scale Venture Partners, Avery Klemmer of Thrive Capital, and Jennifer Lee of A16Z for your responses!