The Environmental Era

The Environmental Era

Could climate consciousness be the key to cracking consumer?

While some kids grow up on bedtime stories about rainbows and butterflies, I grew up on bedtime stories about hippies “seeing” rainbows and pretending to “be” butterflies. Thus, it likely comes as no surprise that as I was raised listening to Joan Baez and eating all things organic, In other words, I had a strong sense of environmental appreciation from day one. While my commitment to crunchy consumption was quirky at best in North Carolina in the mid-90s, this planetary prioritization seems to be (finally) proliferating the mainstream.

Over the past several years, environmental engagement has bubbled up as a key priority for consumers across all walks of life. Today, 56% of global consumers rank climate change as one of the three most pressing issues of our era – and they’re acting accordingly. In recent surveys:

Thanks for reading The Conscious Consumer! Subscribe for free to receive new posts and support my work.

Top of Form

Subscribe

Bottom of Form

42% of respondents have changed consumption habits based on their environmental stances

23% have said they’ll reorient their spend towards organizations that share their values on environmental issues.

For millennials and Gen Z, these issues hit even closer to home.

Nine in 10 millennials and Gen Zs report making an active effort to protect the environment

40% of millennials and Gen Zs say they’ve exerted pressure on their employer to take action.

With legislative, corporate, and consumer-driven initiatives propelling forward efforts to measure, understand, and mitigate climate change, we have officially entered “The Environmental Era.”

Moreover, climate consciousness just might emerge as the key to cracking the consumer code. With this clear incentive alignment, we believe that companies can – and should – compete on climate.

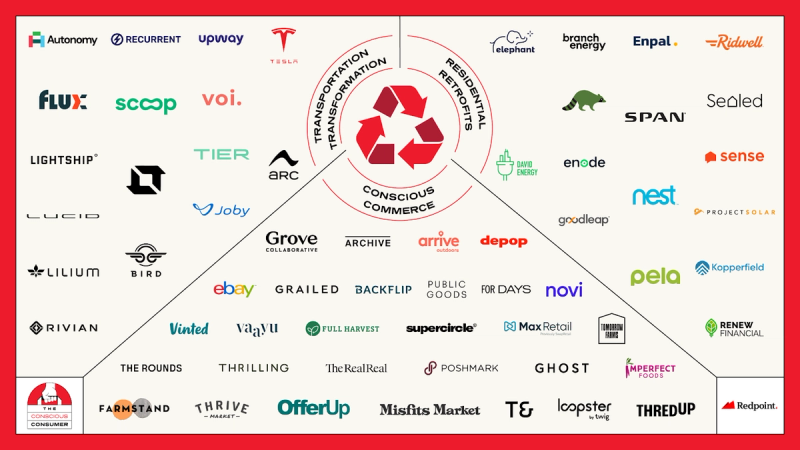

As we anticipate a herd of climate conscious unicorns to emerge over the next several years, we’re building our own planetary playlist here at Redpoint, which today includes emerging opportunities in the following orbits:

Conscious Commerce: Today, we’re increasingly reminded of the words of Joni Mitchell, who told us “You don’t know what you’ve got until it’s gone” in her 1970s banger “Big Yellow Taxi.” With environmental angst rising as fast as global temperatures, consumers’ collective consciousness is driving an accelerating shift in consumption priorities towards a world defined by “conscious commerce.”

While the US makes up only 5% of the world’s population, it produces close to 30% of the world’s waste, meaning we have quite a ways to go in reducing our consumption footprint. While more directed initiatives like California’s SB 1383, which mandates organic waste composting (yes, including food), are establishing formal legal frameworks for more climate conscious consumption. At the same time, and perhaps more powerfully, almost 80% of US consumers today are proactive in considering the sustainability of a product, retailer, or brand on at least some of their purchases.

We’re paying special attention to novel ways to alleviate commerce’s overall environmental impact across materials, manufacturing, logistics, and resale alike.

Key questions we’re exploring:

What roles are the sharing and circular economies likely to play in extending the utility of durable goods?

How will increasingly incorporating sustainability into our collective consideration set shift the ways and types of food we consume?

What role must the cultural zeitgeist play in ensuring that this movement is not a fad but instead the future? And are there interesting distribution strategies that will accompany these commerce plays?

Residential Retrofits: In the 1986 words of Eddie Money, “Take me home tonight.” Few sustainably oriented investment opportunities offer as much environmental upside as the residential construction space.

Today, roughly 20% of domestic greenhouse gas emissions come from residential energy consumption. And increasing evidence suggests that reducing residential energy demand through retrofits represents one of the most cost-effective methods of reducing overall emissions. With policy initiatives ranging from the recent US Inflation Reduction Act (IRA), which offers a 30% tax break for both rooftop solar and battery installation as well as rebates and tax credits for energy-efficient appliances (think heat pumps, electric stoves, electric dryers, and more), to California’s CALGreen (fka Green Building Standards Code), which introduced legislation surrounding planning and design, energy efficiency, water efficiency and conservation, material conservation, and resource efficiency for new construction, top down incentives — and pressure — are heating up.

Looking ahead, we expect to see increasing investment in sustainability-oriented home improvement across both single family and multi family properties, creating clear multi-billion dollar opportunities for installation providers and financing partners alike.

Questions that are top of mind:

Will the residential retrofitters of tomorrow emerge as de novo full stack providers, or will we see embedded offerings transform the toolkits of existing operators?

In order to reach meaningful scale, will companies need to both land within a specific residential wedge and then expand across the broader sustainability spectrum?

Might institutionally oriented green financing solutions (think green bonds and green loans) create rate arbitrage opportunities for the climate friendly fintechs of tomorrow?

Transportation Transformation: As Billy Ocean pleaded in his 1988 classic, “Get out of my dreams, get into my car.” Fortunately, when it comes to transportation, America’s environmentally friendly aspirations are becoming a reality.

With almost 40% of transportation related emissions coming from passenger cars alone, it has become increasingly clear that electrifying our fleet is no longer just a want but now a need. Despite a glaring gap in charging infrastructure and similar support today, 1 in 4 Americans report wanting an electric vehicle as their next car purchase.

Keeping pace, federal and state governments are picking up both policy pressure and budgetary support for this transportation transformation. While progressive bodies like the California Air Resources Board have already mandated that by 2035 all new cars and light trucks sold be zero-emission vehicles, the Bipartisan Infrastructure Law has allocated $5Bn towards the development of a national network of EV charging stations.

Accordingly, we see a wide range of opportunities for investment and innovation as we collectively embark on this new electric era. And of course, key questions have emerged:

With EVs comprising only 1% of cars on the road in the US today, what financial instruments — be they lease or loan like in orientation — will be needed to bridge the affordability gap typically occupied by the used car market?

How might the growing proliferation of these 4 wheeled computers upend the existing underwriting methodologies applied to internal combustion engines?

What EV oriented infrastructure — be it transportation marketplaces, charging systems, or support stations (roadside Genius Bars, anyone?) — is likely to emerge as the new normal over the decades ahead?

While there's ample opportunity for emerging and established companies in the Environmental Era, the path ahead is not an obvious one. For all consumers' stated commitment to environmental engagement, they also show little willingness to compromise on quality, cost, and convenience. Category-defining companies of the Environmental Era will need to meet consumers and prosumers where they are, offer clear cultural and / or economic incentives, and drive delight every step of the way.

If you’re as passionate about marrying the pursuit of profit with purpose as we are, we’d love to hear from you. Find me on Twitter (@itsmeeraclark) or subscribe to my Substack for more.